How a non-US resident can get an EIN Number (Federal Tax ID Number) for a U.S. LLC

Important notes:

- This information is for non-US residents forming an LLC in the US

- Make sure you read what is an EIN and IRS taxpayer ID numbers

Don't have an LLC yet? Hire Northwest to form your LLC for $39 + state fee (then add EIN to your order).

Have an LLC, but no EIN? Hire Northwest to get your EIN:

I have an SSN | I don't have an SSN

There is a lot of incorrect information online about non-US citizens and non-US residents (foreigners) getting an Employer Identification Number (EIN) from the IRS.

Most of the information is wrong or incomplete, either due to lack of knowledge or because someone is trying to sell you something.

At LLC University®, we don’t create content in order to sell you something. We create content in order to educate you.

In this article, we will debunk a few myths and tell you the truth. Then we’ll show you how to get an EIN for your LLC without an SSN or ITIN.

Myth #1 – An EIN costs money

This is false.

EINs are completely free ($0) from the IRS.

The only reason you would pay money is if you hire someone to get your EIN for you.

While you certainly can hire someone to get your EIN, you can also apply for an EIN yourself. It’s not complicated and this article will walk you through the steps.

Myth #2 – You need to be a US citizen or US resident to get an EIN

This is false.

You don’t have to be an American to get an EIN.

You don’t have to be a U.S. citizen to get an EIN.

And you don’t have to be a U.S. resident to get an EIN either.

In fact, there are no citizenship or residency requirements to forming an LLC in the U.S. and there are no citizenship or residency requirements for getting an EIN for your LLC.

As long as you complete Form SS-4 properly (which we’ll show you below), the IRS will give you an EIN for your LLC.

Myth #3 – You need an SSN to get an EIN

This is false.

You don’t need an SSN (Social Security Number) to get an EIN.

You only need an SSN (or ITIN) if you want to apply for an EIN online.

Solution:

You can get an EIN without an SSN by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #4 – You need an ITIN to get an EIN

This is false.

You don’t need an ITIN (Individual Taxpayer Identification Number) to get an EIN.

In fact, you can’t even apply for an ITIN unless you need to file a U.S. tax return. Meaning it’s impossible to get an ITIN before forming your LLC because the LLC would first need to exist and generate income for a tax year, then when April 15th of the following year comes around, you would submit your U.S. tax return along with your ITIN application.

Solution:

You can get an EIN without an ITIN by sending Form SS-4 to the IRS by mail or fax (instructions).

Note: If you read the IRS May 13th 2019 update that says you need an SSN or ITIN, that information is not true. It does not apply to non-US residents or non-US citizens. For more information, please see here: the IRS May 2019 requirements for EIN applications (and why most websites are wrong).

Myth #5 – You need a Third Party Designee to get an EIN

This is false.

You are not required to use a Third Party Designee to get an EIN.

You only need to use a Third Party Designee if you are hiring someone to get your EIN, not if you are applying for the EIN yourself.

Solution:

You can get an EIN without a Third Party Designee by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #6 – You need an attorney or accountant to get an EIN

This is false.

While yes, you can certainly hire an attorney or an accountant to help you get an EIN (they’ll act as your Third Party Designee), you are not required to do so.

Solution:

You can get an EIN without an attorney or an accountant by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #7 – You can get an EIN online

This is false.

You can’t get an EIN online unless you have an SSN or ITIN.

And even if you have an ITIN, many foreigners get an error message (an IRS reference number) at the end of the online EIN application and end up having to use Form SS-4.

Solution:

You can get an EIN by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #8 – You need to call the IRS to get an EIN

This is false.

While yes, the IRS does have a department called the International EIN Department (1-267-941-1099), as a foreigner who’s formed a U.S. LLC, you can’t call this number to get your EIN.

This phone number is used for companies that were formed outside of the U.S., not companies formed inside the U.S. that are owned by foreigners.

Solution:

You can get an EIN by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #9 – You need a U.S. address to get an EIN

This is false.

You don’t need a U.S. office address or U.S. mailing address to get an EIN.

The IRS just needs a “mailing address”, which can be a U.S. address or it can be a non-U.S. address.

However, if you want to open a U.S. bank account for your LLC, it looks much better when your EIN Confirmation Letter shows a U.S. address. For this reason, we recommend hiring Northwest Registered Agent. Northwest will let you use their address for your Registered Agent address, your LLC’s office address, and your EIN application so you can open a U.S. bank account for your LLC. Any mail that is sent to your LLC will be scanned by them and uploaded to your online account.

Sending Form SS-4 to the IRS to get an EIN

Form SS-4 is called the Application for Employer Identification Number (EIN).

Once you fill out Form SS-4 you can then send it to the IRS by mail or fax.

Fax has a faster approval time than mail.

We’ll discuss the details of how to complete Form SS-4 further below, but before we do, there are a few other important things to discuss first.

Make sure your LLC is approved before getting an EIN

Make sure your LLC is approved first before applying for your EIN to avoid having an EIN attached to the wrong LLC name (if your LLC filing gets rejected).

You’ll also want to send to the IRS your LLC approval along with the EIN application. The name of your LLC approval form will vary depending on the state, but it will either be a stamped/approved Articles of Organization, Certificate of Organization, or Certificate of Formation.

However, if you apply for your EIN first and your LLC is later approved, then there are no issues. The IRS doesn’t check to make sure an LLC exists first before getting an EIN, so if the LLC name on your state forms matches your EIN Confirmation Letter, you’re good.

If you apply for your EIN first and then your LLC is rejected because of a name conflict, you’ll need to resubmit your LLC filing forms, get a new EIN, and then cancel your first EIN. You don’t have to wait for your first EIN to be cancelled before getting a new EIN.

The only exceptions are if you’re forming an LLC in Louisiana or West Virginia where you may need to get your EIN before forming your LLC.

EINs are used for:

An EIN is primarily used by foreigners to open a business bank account in the U.S. for their LLC.

Your EIN will also be used for U.S. tax reporting and filing requirements, hiring employees (if applicable), and sales tax licenses/permits.

Your LLC’s EIN will also be used for account registrations for Amazon FBA, eBay, Youtube, Google Adsense, Paypal, Shopify, Stripe, and many more.

Many foreigners have online businesses these days, like dropshipping, affiliate marketing, blogging, and freelance work, where they need an EIN for their LLC.

How to complete the EIN Application (Form SS-4) for Foreigners

Download Form SS-4:

IRS: Form SS-4, Application for Employer Identification Number

Instructions for Form SS-4:

IRS: Instructions for Form SS-4

Complete Form SS-4 by hand or on your computer:

You can either print the form, fill it out by hand (use a black pen), then sign; or, you can type in the form on your computer, then print and sign.

USE CAPITAL LETTERS:

If you are filling out Form SS-4 by hand, we recommend using ALL UPPERCASE letters. The IRS prefers UPPERCASE letters and this can help speed up your EIN application.

EIN (upper right)

You’ll see an “EIN” box in the upper right of the form. DON’T ENTER ANYTHING HERE.

The IRS will enter your EIN number in this field after they approve your application.

1. Legal name of entity (LLC)

Enter your LLC name in the exact same way it’s listed in your Articles of Organization, Certificate of Organization, or Certificate of Formation.

Note: If you’re forming an LLC in Louisiana or West Virginia, you may need to obtain your EIN before forming your LLC, so make sure your LLC name is available (or you’ve reserved it, as per Louisiana LLC filing instructions) before getting an EIN for your soon-to-be LLC.

If you’re forming your LLC in any other state, don’t apply for your EIN until your LLC is approved.

2. Trade name of business (if different than #1)

Most foreigners who have formed an LLC don’t also have a Trade Name (aka DBA, Doing Business As, or Fictitious Name).

Most foreigners leave #2 empty.

(related article: Do I need a DBA for my LLC?)

If on the other hand, you’ve filed a DBA after forming your LLC, your DBA is owned by your LLC, and you want your LLC to do business under that name, then you can enter your Trade Name/DBA Name/Fictitious Name in #2.

3. Executor, administrator, trustee, “care of” name

Leave this empty. This field does not apply to LLCs obtaining an EIN.

4a and 4b: Mailing address

On lines 4a and 4b enter a mailing address where the IRS can send you reminders and tax documents.

This address can be a U.S. address or it can be a non-U.S. address. This address can be the same address you used listed on your LLC filing forms, but it doesn’t have to be.

This address should be one that is reliable and where you can regularly receive mail for your LLC. This should also be the address that you will use when filing future tax returns with the IRS.

However, using a U.S. address here may make it easier when opening up a U.S. bank account. The address that is listed in 4a and 4b will be the same address that is listed at the top of your EIN Confirmation Letter. Some banks accept this as a proof of U.S. address.

The best and least expensive way to get a U.S. address (if you don’t have friends or family in the U.S.) is to hire a Registered Agent that will allow you to use their address not only as your LLC’s Registered Agent address, but also as your LLC’s office address. The company we recommend for this is Northwest Registered Agent. They’ll let you use their address for your U.S. LLC and any mail that is sent to your LLC will be scanned and uploaded to your online account. They are a great company and have been in business for over 20 years.

Notes:

- If the address is a non-U.S. address, make sure to enter the city, province (or state), postal code, and the name of the country. Enter the full country name. Don’t use an abbreviation.

- If you need to change your LLC mailing address with the IRS in the future, you file Form 8822-B.

5a and 5b: Street address (if different)

You can leave 5a and 5b empty.

6. County and state where principal business (LLC) is located

Enter the county (not the country) where your LLC is located in the U.S.

This will either be your LLC’s principal address or your LLC’s Registered Agent address.

Example: Broward County, Florida

Tip: To find out what county your LLC’s address is located in, you can use the following tool: What County Am I In.

7a. Name of Responsible Party

The EIN Responsible Party must be an individual person, therefore, it will be an LLC Member (owner).

If you own a Single-Member LLC, you will be the Responsible Party.

If you own a Multi-Member LLC, any of the LLC Members (owners), including yourself, can be the Responsible Party.

7b. SSN, ITIN, or EIN (of Responsible Party)

This is the box that confuses most people who don’t have an SSN or ITIN and want to get an EIN for their LLC.

The solution is to enter “Foreign”.

The IRS issues EINs to foreigners all the time and this is what you must enter if you don’t have an SSN or ITIN.

Note: If your LLC is owned by another LLC (a “Parent LLC”), you can’t use your Parent LLC’s EIN. You must enter “Foreign”. And you also must list a person (not a company) in 7a.

For more information, see EIN Responsible Party for LLC.

8a. Is this application for a limited liability company (LLC)?

Check off “Yes”.

8b. If 8a is “Yes,” enter the number of LLC members

Enter the number of LLC Members (owners) for your LLC.

Single-Member LLC: Enter “1”.

Multi-Member LLC: Enter the total number of Members in your LLC.

Note: If your LLC is a subsidiary owned by another company (or companies), enter the number of companies that own this LLC.

8c. If 8a is “Yes,” was the LLC organized in the United States?

Check off “Yes”. Although your LLC will be foreign-owned, your LLC will still be organized in the United States.

9a. Type of entity

Notes:

- We recommend that you have a conversation with an accountant before deciding how your foreign-owned LLC will be taxed.

- The term “foreigner” means non-resident alien.

- The term “U.S. person” means U.S. citizen or U.S. resident alien.

You will pay U.S. taxes based on what country you are from, what tax treaty is in place, how and where your LLC makes money, where your clients are, if your LLC has a “permanent establishment” in the U.S., if your LLC’s income is “effectively connected” to a U.S. trade or business, and much more.

Taxes are complicated for U.S. residents. Taxes are more complicated for foreigners, so please speak with a professional.

We are unable to provide tax assistance or tax advice. Thank you for understanding.

Single-Member LLC (foreign-owned):

If you have a foreign-owned Single-Member LLC you can choose to be taxed as a Disregarded Entity or as a C-Corporation.

– If you want your LLC to be treated as a Disregarded Entity, check off “Other (specify)” and enter “Foreign-owned U.S. Disregarded Entity” on the line.

– If you want your LLC to be treated as a C-Corporation, check off “Corporation (enter form number to be filed)” and enter “1120” on the line. After you receive your EIN you must then file Form 8832 to make your C-Corporation election.

Notes:

- All foreign-owned Single-Member LLC Disregarded Entities must file Form 5472 every year. More information here: Form 5472 and foreign-owned LLC.

- If your Single-Member LLC is owned by a foreign company, your LLC will be considered a branch or division of the parent company for tax purposes.

- If you are considering LLC taxed as C-Corporation (which is not very common), please see here: LLC taxed as C-Corp.

Multi-Member LLC (foreign-owned):

If you have a foreign-owned Multi-Member LLC you can choose to be taxed as a Partnership or a C-Corporation.

- If you want your LLC to be treated as a Partnership, check off “Partnership“.

- If you want your LLC to be treated as a C-Corporation, check off “Corporation (enter form number to be filed)” and enter “1120” on the line. After you receive your EIN you must then file Form 8832 to make your C-Corporation election.

Note: The same thing will apply to Multi-Member LLCs that are owned by a foreigner (or foreigners) and a U.S. person (or persons). You can choose for your LLC to be taxed as a Partnership or a C-Corporation. If you are considering LLC taxed as C-Corporation (which is not very common), please see here: LLC taxed as C-Corp.

9b. State & foreign country (if applicable)

State

Enter the state where your LLC was formed. Use the state’s full name. Don’t use an abbreviation.

For example: enter “Florida” (not “FL”).

Foreign country

Don’t enter anything here. Leave this blank.

Note: These instructions are non-US residents that formed an LLC in the US. These instructions are not for people who formed a company outside of the US.

10. Reason for applying

Select “Started a new business (specify type)” and enter the type of business your LLC will be engaged in to the right.

The best place to start is to look at the options in #16. If one of the default checkboxes in #16 matches your LLC’s business purpose, then just enter those words here in #10.

If not, enter a word (or words) you see fit, or you can use language from the NAICS Code, which is the business classification system used by the IRS.

The NAICS Code (North American Industry Classification System) is used by government agencies to identify a business’s line of work.

The IRS uses the NAICS Code for two primary reasons:

- Statistical purposes which are used to produce reports and industry analysis.

- In the case of an audit, the IRS will know how a business may compare against similar businesses in the same industry.

Please see NAICS Code for LLC for more instructions on how to find the NAICS Code for your LLC.

Note: Although your foreign-owned LLC may have multiple purposes, multiple products or services, and multiple revenue streams, just enter the primary business activity. And don’t worry, this doesn’t force your LLC into doing this forever. You can also change your LLC’s line of work at any time and you don’t need to update the IRS. This information is just needed on the LLC’s initial EIN application.

11. Date business started

Enter the date (month, day, and year) your LLC was approved by the state (aka the LLC effective date).

Look on your approved Articles of Organization, Certificate of Organization, or Certificate of Formation (different forms for different states) for your LLC’s approval date.

This is the date your business started, even if there wasn’t actual business activity.

It should be formatted like this: month/day/year. For example, if your LLC was approved on January 15th 2024, you would write 01/15/2024.

12. Closing month of calendar year

Most foreigners run their taxes on the calendar year, which is January through December. If that’s the case for your LLC, enter “December”.

13. Employees

Note: Most foreigners won’t have U.S. employees, so this section may not be applicable. Most foreigners will be entering “0” “0” “0” in #13.

When hiring a W-2 employee, as their employer, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment taxes on their wages.

On the other hand, you can hire 1099 independent contractors, in which you are not responsible for withholding and paying the above taxes.

We cannot help you determine whether someone is an employee or an independent contractor, however, you can speak with your accountant, in addition to reading the following information provided by the IRS: employee vs independent contractor.

If you plan to hire U.S. employees within the next 12 months, then enter the approximate number of employees in each category (Agricultural, Household, and Other). If there won’t be employees in a certain category, enter “0”. Don’t leave any field empty.

If you won’t be hiring U.S. employees within the next 12 months, you’ll need to enter a “0” “0” “0”.

An agricultural employee is someone who works on your farm and may take on various roles, such as harvesting agricultural or horticultural products, raising livestock, operating machinery, clearing land, and more. For more details on agricultural employment, please see page 9 of the following IRS guide: Agricultural Employer’s Tax Guide.

A household employee is someone who works in or around your home on a regular and continual basis. Think of wealthier people who employ people in their home on a regular basis. Some examples are maids, housekeepers, babysitters, and gardeners. And keep in mind, this isn’t the same thing as hiring these people in an independent contractor scenario. For more information on what determines a household employee, please see this page from the IRS: household employees.

For the majority of foreigners who have (or plan to have) U.S. employees, their employees will likely fall within the “Other” category.

Important: Just being an owner of your LLC doesn’t make you an employee of your LLC.

14. Employment tax liability

Note: Most foreigners won’t have employment tax liability, so this section may not be applicable. Most foreigners will just leave the box unchecked.

If you have (or will have) U.S. employees, you’ll need to withhold and pay certain taxes to the IRS on behalf of your U.S. employees. Please speak with your accountant to first estimate your employment tax liability.

If your employment tax liability will be less than $1,000 in an entire calendar year, you can choose to file Form 944 annually (instead of filing Form 941 quarterly). If you’d like to do that, you’ll need to check the box in #14.

Leave the box unchecked in #14 if:

- You don’t have U.S. employees

- Your employment tax liability will be greater than $1,000

- Your employment tax liability will be less than $1,000, but you’d rather file Form 941 quarterly

15. First date wages or annuities were paid

Note: Most foreigners won’t have wages or annuities paid, so this section may not be applicable. Most foreigners will just enter “N/A”.

If you don’t have employees, enter “N/A”.

If you have U.S. employees and have already begun paying wages (or annuities), enter the date (month, day, year) they were first paid.

If you have U.S. employees, and you’re not sure when you will begin paying them, just enter an estimated date. Don’t worry, the IRS isn’t going to hold you to it and it won’t mess up your EIN application. You’re simply just giving them an approximate heads up.

16. Principal activity

You can make #16 match what you entered in #10.

Check a box if it’s applicable or select “Other (specify)” and enter whatever you entered in #10.

17. Explain #16 (merchandise, construction, products, or services)

#17 is just asking for a little more details regarding your LLC’s principal business activity.

The IRS wants to know, within that type of business activity, what is your primary product being sold, service being offered, type of construction being done, or line of merchandise you’re selling.

Just enter a few words to explain your LLC’s principal business activity.

18. Applied for an EIN before?

If you’ve applied for an EIN for this LLC before, select “Yes” and enter the previous EIN.

Most foreigners have not applied for an EIN for their LLC and they select “No.”

Third Party Designee

If you’re completing this form for your own LLC and you are the Responsible Party, then leave the following 4 fields empty:

- Designee’s name

- Designee’s telephone number

- Designee’s Address and ZIP code

- Designee’s fax number

Applicant’s signature, phone, and fax

Name and title: Enter your full name and title. If you are the LLC Member (owner), use the title “Member”. For example, “John Smith, Member“.

Signature and date: Sign your name and enter today’s date.

Applicant’s telephone number: Enter your phone number. This can be a home, office, or cell number. This number can be a U.S. phone number or it can be a non-U.S. phone number. If you’re entering a non-U.S. phone number, make sure to put the country code at the beginning of your number.

Applicant’s fax number:

- If you are submitting SS-4 by mail, you don’t have to enter a fax number. You can leave this empty.

- If you are submitting SS-4 by fax, then you must enter a fax number. The fax number can be a U.S. fax number or a non-US fax number.

Page 2

Page 2 is just an informational page and you don’t have to submit it to the IRS. Although, if you happen to send in Page 2, don’t worry, the IRS will just throw it away.

Make a copy of Form SS-4 before sending to the IRS

We recommend making a few copies of Form SS-4 before sending it to the IRS.

Just keep the copies with your LLC’s business records.

Include your LLC approval document

Along with Form SS-4, send the IRS your stamped and approved LLC documents.

Depending on the state where you formed your LLC, this document will be called one of the following:

- Articles of Organization

- Certificate of Organization

- Certificate of Formation

How to file Form SS-4

You can send Form SS-4 to the IRS in one of two ways:

- By mail

- By fax

The approval time for fax is 4 to 8 weeks.

The approval time for mail is 6 to 8 weeks.

Note: There is a delay because of the pandemic. It can take 2.5 to 3 months to get an EIN if you file by fax. It can take 3 to 3.5 months to get an EIN if you file by mail. After 62 days, you can call the IRS and ask for an EIN Verification Letter (147C). There is no other way to get an EIN for non-US residents, so please be patient.

If you’re mailing Form SS-4 to the IRS

You can mail Form SS-4 to the IRS from any country. It doesn’t have to be from the U.S. And it doesn’t matter what address you list on the envelope as your “from address”.

Just mail your completed and signed SS-4 form to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, Ohio 45999

Note: There is no street address (ex: “123 Main Street”) for the IRS. The above address is the complete address.

If you’re faxing Form SS-4 to the IRS

If you want to fax Form SS-4 to the IRS for a faster approval time, fax SS-4 to:

1-855-641-6935

No cover sheet needed:

You don’t need a cover sheet with your fax. You can just fax page 1 of Form SS-4 to the IRS.

Digital fax recommendation:

We recommend using Phone.com. You will get a digital fax service included when you sign up for a U.S. phone number. Their plans start at $13 per month.

After you sign up with Phone.com, you can just call their support team or do a live chat and they’ll show you how to send a digital fax. It should only take you a few minutes.

Note: You can use any digital fax service. It doesn’t have to be Phone.com. Phone.com is just the service we use and recommend.

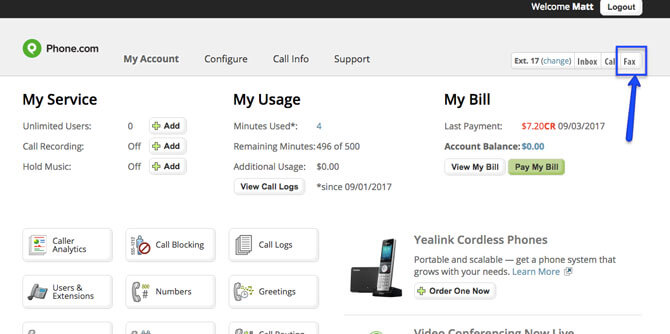

Once in your account, click “Fax” in the upper right corner.

Then enter the IRS fax number at the top, followed by your name and email.

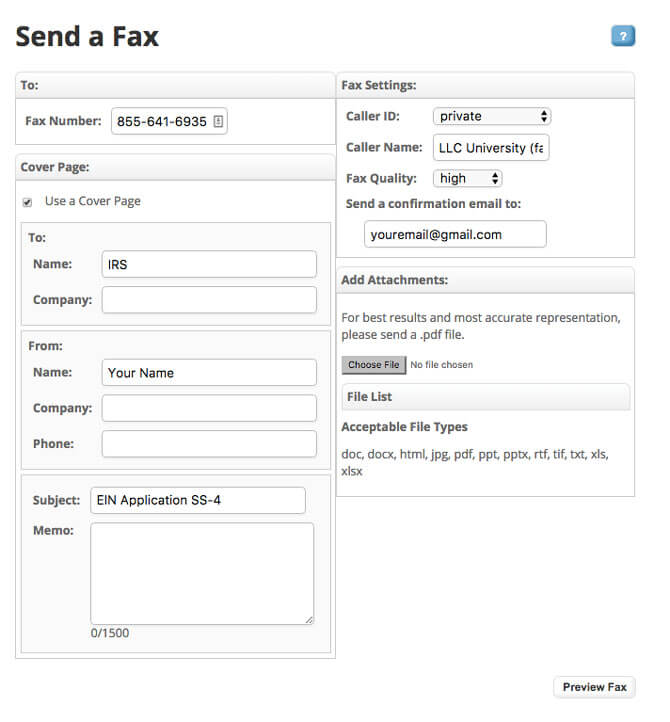

Here is a screenshot from the fax setting page:

Set the fax quality to “high” and then click “Choose File” under “Add Attachments”.

Once ready, click the “Preview Fax” button at the bottom.

Note: On the next page you’ll see a note about “FCC regulations require us to use a US geographical caller ID when sending faxes to toll-free numbers”. This is just Phone.com letting you know that your “from” fax number will be different. But don’t worry, this will not impact your EIN fax application with the IRS at all.

Click the “Send Fax” button at the bottom to fax your EIN application to the IRS.

Congratulations. Your EIN application has been sent to the IRS for processing!

Now you just need to wait for your EIN approval.

EIN approval time for foreigners

If you faxed Form SS-4 to the IRS

If you faxed Form SS-4 to the IRS, it can take 4 to 8 weeks before they fax you back your approved EIN Number.

Note: There is a delay because of the pandemic. It can take 2.5 to 3 months before you get your EIN Number for your LLC. After 62 days, you can call the IRS and ask for an EIN Verification Letter (147C). The 147C instructions are linked below. There is no other way to get an EIN for non-US residents, so please be patient.

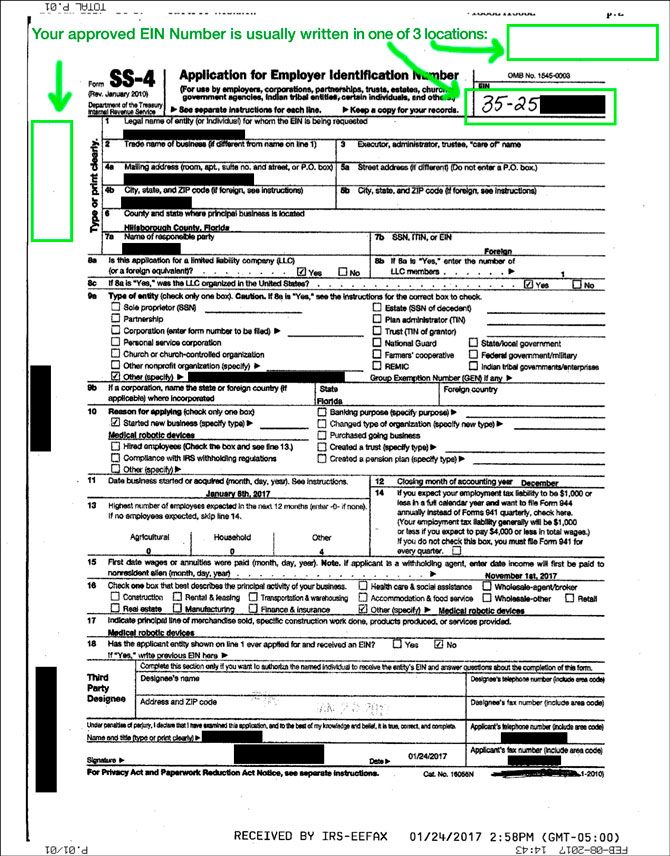

Your approved EIN Number will be handwritten on your SS-4. It looks unofficial, however, it is official.

Here is what the approved SS-4 fax looks like:

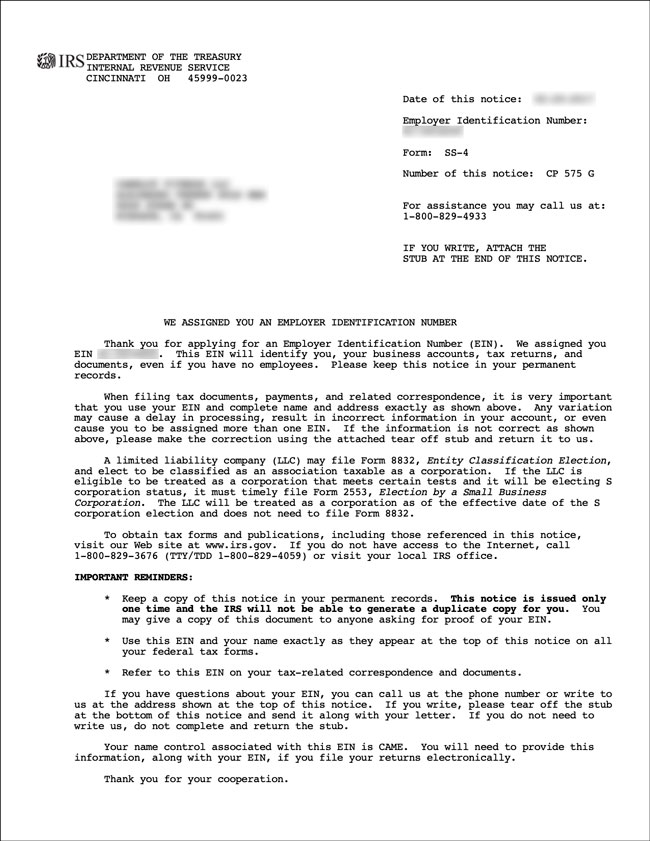

At the same time as the fax approval, the IRS will also mail you another confirmation letter. This letter is called the EIN Confirmation Letter (CP 575). The EIN Confirmation Letter will be mailed to the address you listed in 4a and 4b. This will usually arrive 1-2 weeks after you get the fax.

Here is what the EIN Confirmation Letter (CP 575) looks like:

If you have the approved fax, but have not received the EIN Confirmation Letter (CP 575), you can get an EIN Verification Letter (147C) while you wait for your EIN Confirmation Letter (CP 575).

The 147C serves the same purpose as the CP 575. They are both official letters from the IRS that show the approved EIN Number for your LLC.

Once you have your EIN Number, you can proceed to open a non-US resident LLC bank account and continue on with your business.

If you mailed Form SS-4 to the IRS

If you mailed Form SS-4 to the IRS, it can take 6 to 8 weeks before they mail you back your approval.

Because of the pandemic, there is a delay. It can take 3 to 3.5 months before you received your EIN Confirmation Letter (CP 575) in the mail.

They will mail you an EIN Confirmation Letter (CP 575). It will be mailed to the address you listed on 4a and 4b. Please see above for a screenshot example.

Please be patient and don’t send SS-4 multiple times

At maximum, we have seen that it can take up to 2 months before an EIN is approved for a foreigner.

Please be patient and don’t resend SS-4 to the IRS. Doing so can create confusion and delay the approval time.

Also, please keep in mind that the IRS is busiest in January, March, April, and October, and December. So please be extra patient during these times of the year.

If you feel you’ve waited long enough, but still haven’t received your EIN approval, you can call the IRS and request an EIN Verification Letter (147).

How foreigners can open US LLC bank account

The three most common ways to open a US bank account are:

- Travel to the US and open a bank account in person

- Open an online payment account with TransferWise

- Open an online bank account with Mercury

For more details and the pros and cons, please see this page: How a non-US resident can open an LLC Bank account in the US.

Form 5472 requirements for Single-Member LLCs

If you have a foreign-owned Single-Member LLC (one owner), you must file Form 5472 and Form 1120 with the IRS every year.

If you don’t, the IRS can charge penalties.

For more information, please see this article: foreign-owned Single-Member LLC and Form 5472.

U.S. taxes for foreigners

This page does not discuss additional tax requirements that foreigners must follow in order to properly report and file taxes with the IRS.

You will need to hire an accountant who works with foreigners that have a U.S. LLC.

We recommend sending an email to Gary at GW Carter. His office specializes in working with non-US residents that have US LLCs.

Some of our readers (those with Single-Member LLCs and online businesses) may not have US tax filing obligations (except for Form 5472).

However, other readers (with Multi-Member LLCs) have to file a 1065 return with the IRS.

And other readers (depending on the type of business and what country they are from) need to file a 1040NR with the IRS and get an ITIN (Individual Taxpayer Identification Number).

Gary can help figure out your US tax obligations and he can file them for you.

Here are a few of the things that may apply to you:

- Sales tax and/or excise tax

- Effectively Connected Income (ECI)

- Fixed, Determinable, Annual, Periodic Income (FDAP)

- Conduct of a U.S. trade or business (USTB)

- Federal Withholding Tax for Foreign Nationals

- Foreign Bank Account Annual Report (FBAR)

- Payroll taxes (if applicable)

- Form 1042-S

- Form W-8 BEN

- US Nonresident Alien Income Tax Return (1040NR/1040NR-EZ)

- Federal and state unemployment taxes (if you have U.S. employees)

- Real Estate and Foreign Investment Real Property Tax Act (FIRPTA)

How to find an accountant for a foreign-owned LLC?

Besides our recommendation of Gary at GW Carter, you can also use our “knights of the roundtable” strategy along with the IRS Acceptance Agent list.

The IRS Acceptance Agent page lists tax professionals that work with foreigners. You’ll want to find about 5-10 tax professionals that are located in the same state where you formed your LLC.

Write down their information and call them all and ask a few questions (or email them). Each tax professional will give you a few minutes of their time since you are a potential customer.

Then use our “knights of the roundtable” strategy when making your phone calls/sending emails. This will help you eliminate bad candidates and find the best tax professional for your LLC.

Worldwide information sharing & tax treaties

The U.S maintains tax treaties with over 60 countries around the world. These treaties usually include disclosure agreements, where each government agrees to share information on a person or LLC’s taxable activity outside their country of origin when requested by his home country.

The agreements are in place to make sure that people and companies who earn income outside their home country file the proper returns and pay their taxes in both the U.S. and in their home country.

IRS Contact Information

You can call the IRS at:

The International Department at 1-267-941-1000. Hours are Monday through Friday, 6am – 11pm, U.S. Eastern Time.

OR

The EIN Department at 1-800-829-4933. Hours are Monday through Friday, 7am – 7pm, local time.

It’s important to know that the IRS will answer general questions, but they don’t give out tax advice and can’t explain every single requirement to you over the phone. For that reason, as we’ve mentioned earlier, it’s a good idea to find an accountant for help.

References

IRS: How to Apply for an EIN

IRS: Taxation of Nonresident Aliens

IRS: Taxation of Nonresident Aliens 1

IRS: Publication 901 – US Tax Treaties

IRS: United States Income Tax Treaties A to Z

IRS: Publication 519 – US Tax Guide for Aliens

IRS: LB&I International Practice Service Transaction Unit

IRS: Form 8833 – Treaty-Based Return Position Disclosure

US 26 CFR 1.513-1: Definition of unrelated trade or business

US 26 CFR 1.864-4: U.S. source income effectively connected with US business

IRS: Publication 515 – Withholding of Tax on Nonresident Aliens and Foreign Entities

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Let me share with you:

– I sent the fax to IRS in June 5th

– I received the EIN number in June 24th.

Less time than I thought.

Thanks for information.

That is great to hear! You’re very welcome. Thanks Rafael :)

Is one able , Under a TN VISA from Canada working in the UNITED STATES with SSN,

Sponsored by a company, able to open an LLC in texas or ecommerce via WYOMING, and do airbnb arbitrage under that LLC?

Hi Wilson, I recommend speaking with an immigration attorney, however, at a surface-level glance, as per the Code of Federal Regulation (Section 214.6), it seems forming an LLC may jeopardize your TN VISA:

“Engage in business activities at a professional level means the performance of prearranged business activities for a United States entity, including an individual. It does not authorize the establishment of a business or practice in the United States in which the professional will be, in substance, self-employed. A professional will be deemed to be self-employed if he or she will be rendering services to a corporation or entity of which the professional is the sole or controlling shareholder or owner.”

Hi, Many many thanks for details instruction.

1. can i apply ein by phone call? if yes, pls make an instruction for that.

2. here is my ss4 form, pls check & suggest if any wrong: [LINK REDACTED]

Thanks in advance.

Hi Mashfiq, you’re very welcome! Technically, you can’t apply by phone. The “international” phone number (1-267-941-1099) is for already existing businesses (formed in other countries) that need an EIN for US operations. However, you can try. It works some of the time (it really just depends on who answers your call). I reviewed your Form SS-4. Everything looks great, except there’s one small change needed. You have “Sheridan” (the city) on line 4a. It should go on line 4b (ex: Sheridan, WY 82801). All else is good. Hope that helps :)

Hi Matt Horwitz,

Many many thanks for reply.

You’re very welcome Mashfiq :)

Hi

I applied for EIN on 03/02/2023 but so far no sign…is there any way to contact the IRS to find out the status of my application.

Thank you

If the EIN has been processed, you can request a 147C EIN Verification Letter.

i dont now if it has been processed or no, I did not receive any answer

You can ask when you call regarding the 147C.

Hello,

I created an LLC in New Mexico and I applied for EIN. My concern is the number fax to send to the IRS. I faxed to +1 304-707-9471 because I apply from outside the USA. It is correct? If it is not correct, can I send again to the correct number?

Thanks

Hello, that’s fine and correct. It doesn’t really matter which number you fax it to. So just wait until you hear back. Don’t send the application in twice. That can mess things up. Hope that helps.

It seems a bit complicated, but you demonstrated with detailed steps. I finally hired someone to help me get it, but this article still helped.Thanks

You’re very welcome John. It can certainly feel like a lot, especially the first time you look at it. However, I’m glad you hired someone and it’s getting done.

Thank you for the information! Tell me please will this work for corporations? Will they get an EIN if owner answers ”foreign” in line SSN/ITIN ? It is make sense for example in NY to nonresident aliens could open Corp instead of LLC and do not pay for publications

Yes, this also applies to Corporations, just like LLCs; non-US residents can get an EIN for a Corporation without having an SSN or ITIN.

Thank you! But if the owner does not have an SSN then it should be C-Corp, right? He is not able to choose S-Corp because He can’t pay salary, isn’t he?

Whether or not someone has an SSN doesn’t dictate the “best” entity. S-Corp is a tax election (not an entity). But correct, foreigners can’t own an S-Corp (or rather, an entity taxed like an S-Corp). However, a foreigner can form an LLC or a Corporation.

Thank you Matt

how long it will take to get EIN nowadays, usually I used to fax IRS for EIN but now it is taking more time as before, any reason, thank you

Hello, did you receive your EIN by fax or mail? We haven’t received any news from the IRS yet that we have applied by fax on 3rd of January. It has been 5 weeks.

about 4-6 weeks at this moment

It can also be longer; up to 2-3 months. The IRS has been delayed since covid. Sometimes they are fast, but it’s not gauranteed.

Hi Hashmi, for some, it’s a few weeks. For others, 2-3 months.

Hi! Will I eventually need to get an ITIN if I apply for an EIN as a foreigner?

It depends. If you have a US tax filing requirement or you need a merchant processor, then an ITIN will be needed.

Hi,

I sent the fax two weeks ago and got an empty fax with some lines (gibberish). What does this mean?

Thanks

Hi Sid, I’m not sure. I recommend calling the IRS and requesting a 147C EIN Verification Letter.

Hello Matt, can I apply for a EIN as a foreigner without SSN for a Church? I am the Church Director and EIN is needed for banking purposes.

Hi Christian, we only know about non-US residents getting EINs for LLCs, however, the process could be the same. I’d say there’s no harm in trying :) Hope that helps.

4 hours in your site give me information more than I finded in Google last 2 weeks.

You saved my money. Thanks for this information!!!

Peter, so glad to hear that! We’re happy we could be so helpful. You’re very welcome :)

I agree this is the best educational site ever! Really shows he actually applies the practical knowledge and skills he mastered!

Hard to find these days. So many generic sites. And don’t actually help human beings.

Thankful for llcuniversity💜

Thank you so much Star! We do our best, and certainly appreciate your kind words :) You’re very welcome!

Hi Matt, I just wanted to drop a quick line to give my thanks to you for providing such incredible LLC resource guide with the most accurate and up to date information. I tried to form an LLC 5 years ago, but was unsuccessful due to a catch 22 type situation, as the govt. website is so inaccurate and unhelpful. I wish I had found your site sooner, but I’m led to believe I found it when the timing was more fortuitous. I applied via fax Dec 4 2020 and received my EIN number in the mail Feb 27, 2021. I probably would have had it 2 weeks sooner if I had an incoming fax number. I can’t thank you enough, this has been a long time coming for me. I’m going to continue to follow your advice. The step by step phases and instructions just blow my mind!!! Amazing!!!

Hey Viv, wow, thank you so much! I’m so happy to hear all that. So glad we could help :) Thank you again for your kind words and I wish you all the best!

Hi Matt! One million thanks for all this information. This is so helpful! You have no idea!

I just want to make sure that my situation is actually a “foreign-owned US LLC”.

So I am an European citizen living in Europe, forming an LLC in New Mexico (Thanks for your blog on how to set up a business in NM, super helpful as well!), using a family member’s address (from North Carolina) for section 4a and 4b and a registered agent in NM.

– Can you confirm that my situation is actually that of a “foreign-owned US LLC”? Because I am a bit confused since I am not sure of “foreign-owned” means that the LLC is owned by another foreign company that wants to operate in the US, or if a “foreign-owned” just means owned by a foreign person… or both.

– Also, you reckon is a good idea to put my family member’s address from NC in the mailing address? Or should I just put the registered agent’s address from NM? The family member is completely reliable.

Thanks again Matt!

Hi Kevin, I apologize for our slow reply. Thank you for the kind words :) And you’re very welcome! Yes, your LLC is a foreign-owned US LLC because you are a non-US resident (aka non-resident alien). And most of the time, a US LLC owned by a foreign company is also a foreign-owned US LLC. And yes, that’s totally fine that you used the family member’s address in North Carolina. The IRS doesn’t really care about the Registered Agent. They just want a “mailing address”. Hope that helps.

Hi Matt,

This article was very helpful. You’re awesome. I was wondering if you could guide on how to get sales permit without SSN/ITIN specifically Texas Sales tax permit for an LLC if you are not in US.

Hi Matt,

Wanted to see if you had a chance to look into my question. Would really appreciate your help.

Regards,

Hi Sami, apologies for the slow reply. We got backed up. Thank you! We don’t cover sales tax permits at this time. Thank you for your understanding.

Hi,

In the pandemic section, you said “There is no other way to get an EIN for non-US residents, so please be patient.” Do you mean that non-US residents should NOT send mail/fax to IRS for EIN during this time? I’m a non-US resident but I have a US address with a business located within the US.

Thanks

Hi Garry, no. It just means to file by mail or fax and be patient. There isn’t another way to file besides by mail or fax.

Hi Matt!

First of all thank you very much for great information you provide, your blog is really great!

I want to find out if we have a friend in USA with SSN can he/she apply online for EIN for out LLC? or they must be members of LLC to be able to apply EIN online?

Same question for registered agent ; can registered agent of my LLC apply for EIN online ? or he/she also must be a member of my LLC?

Thanks for your help

Have a great day!

Serkan

Hi Serkan, you’re very welcome :) The EIN Responsible Party is supposed to be a Member of the LLC. If someone else gets the EIN, you can change the EIN Responsible Party.

Hello Matt –

just a quick question , i am a canadian citizen , who has opened LLC through registered agent in US and thats the only address we have and now i am applying for SS-4 EIN , so the question is where should i be mailing the documents to ?

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

OR

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

little confusing any help would be appreciated

Hi Moe, the “Attn: EIN Operation” one. Also, we recommend speaking with an accountant. Typically, Canadians with US LLCs file and pay taxes with the IRS and the CRA. You may want to change the tax classification of your LLC or consider another entity setup. I don’t know the specifics, but I do know this is a thing.

Hello Matt,

Thanks for all the useful information provided here.

I have applied for an EIN via fax as a non resident alien. I sent it in early December 2020 but did not received any response yet. Is that normal? Do you think that I should I resend the SS-4 to the IRS?

Thank you very much in advance.

best,

Sorry!! I have just realised that my question is already answered in the post. There is a delay due to COVID-19.

Thank you anyway. My apologies.

All the best!!

No worries Gonzalo! You’re very welcome :)

Hi Matt,

Amazing information you have, and I truly appreciate all the efforts you’ve taken to build such useful content AND also it’s applaudable that you reply to every single comment. Keep it up, man!

I’ve saved a lot of money by following your guides.

I have registered an LLC in Delaware from North West, and what an awesome experience it has been! Support has also been very great and helpful.

I am preparing to file the EIN Application by fax. One question I have is I have opted for the regular LLC Formation plan of North West, which includes Registered Agent fees.

1) Can I use the same registered address in my EIN application, OR would I need a Virtual Office separate plan?

2) If I do NOT opt for their virtual office plan, would I receive a scanned copy of the document that is sent by EIN to that registered address (which is from North West as part of their “Registered Agent” plan, which is the same on the “Certificate of Formation”).

Thanks once again.

Cheers!

Raj

Hey Raj, thank you so much! I really appreciate the kind words :) While Northwest will still scan the mail that arrives, they really prefer not to be used for IRS (or banking) mail. With the IRS, you can just use your home address in your country. The address doesn’t have to be the address of the LLC. To the IRS, it’s simply a “mailing address” that can be located anywhere in the world. Hope that helps.

Thanks for the reply, Matt. Appreciate the quick response :)

Okay, if I use my home country in the EIN application, will that still be acceptable to open a US Bank account (I am going with your recommendation- Mercury Bank).

If I later add a Virtual office solution from North West, would I be able to update this address, just in case if I ever need to?

Thanks again.

Hi Raj, sure thing ;) Yes, Mercury will accept the EIN with any address. And yes, you can change the address of your LLC with the IRS at any time by filing Form 8822-B. Please see How to change LLC address with the IRS. Tip: When completing the Mercury application, add a detailed description of the business and include any business or personal social media links, like a website and LinkedIn profile. This will help when they review your application.

I formed company in Wyoming and sent SS-4 along with Articles of organization by fax as you suggested.

The articles of organization includes only the organizer registered agent name and not my name. Will the IRS refuse my SS-4 because of this? should I have sent the operating agreement with the fax?

Hi Rahil, this is common. LLC Members are not listed in the Articles of Organization in many states. You shouldn’t have any issues :) You don’t need to submit the LLC Operating Agreement.

Thank you, man! You honestly helped me so much with this application! Just sent it in and I’m excited to get it!

Awesome! You’re very welcome Michael :)

Hi Matt,

Many thanks for the invaluable information you have made available to us all.

I just opened a single-member LLC and have sent a fax to the IRS, so I am presently awaiting my EIN. I, however want to open another LLC for for I and my spouse. Do I need to apply for an EIN for myself again? Do I need to apply for her? If I was to open another single-member LLC, do I still need to apply for another EIN or can I use the one for all other LLCs formed.

Thanks.

Kay

Hi Kay, you’re very welcome! Each LLC will need its own EIN. I think there is a typo in your sentence about you and your spouse. Feel free to ask again if I missed anything.

I think you have answered it…. “each LLC will need its own EIN”.

I want to open another LLC in Wyoming for I and my spouse and request for an EIN, can we be taxed as a single entity instead of separate individuals? Is there a provision for that?

Hi Kay, okay, wonderful. No, a Multi-Member Wyoming LLC wouldn’t qualify to be taxed as a Qualified Joint Venture LLC because the LLC is not in a community property state. It will be taxed as a Partnership.

Hi Matt,

Thank you so much for this awesome and very informative article because I was scratching my head for a few months to overcome the barriers of starting a business in USA and to get a US bank account and apply for a Stripe account. I applied last December and now waiting for the reply from IRS.

I can’t thank enough you Matt because there so many entrepreneurs from the outside of USA who are willing to start a business properly and this the best article I found.

Thanks,

Rumesh

Hi Rumesh, you’re very welcome. I’m so happy to hear all that and I’m happy that we could help :) I wish you all the best with your business!

I am a US citizen and resides here in the States, can I file/fax the EIN on behalf of some one outside the country?

Hi Akua, they would need to sign the form. They can certainly use your fax number if that’s what you’re asking.

Hi, how are you? actually, my prob is that I send my SS4 Form and LLC documents via Efax. I filled my form online on Adobe reader because it was fillable. but as I send it, all the fillable text vanished…Idk what happened to it. plz, help what should I do now..?

Hi Abdul, this is due to the funny behavior of how PDF files sometimes interact with the web browser. It means you are editing the PDF file in the web browser and not inside an application (like Adobe Acrobat). So while the file looks like there is content, the PDF is actually blank. You’ll need to use an application like Adobe Acrobat (I believe there are others, too) to edit the PDF, sign it, and save the file. And then fax that and the LLC approval (Articles of Organization, Certificate of Organization, or Certificate of Formation) to the IRS. Hope that helps.

Hi Matt,

Thank you for the useful information! I am a foreigner living outside US. I have got the confirmation letter from IRS for my SS4 application, however there is a mistake with the Legal Name on the confirmation letter. What should I do? Thank you!

Hi Katie, you’re very welcome! What kind of mistake? Would you mind sharing the name of the LLC and how the name appears on the EIN Confirmation Letter? If you don’t want to share the LLC name, feel free to make up a names. Thanks.

Hi Matt,

My SS4 application was not for a LLC. The Legal Name has a word “ULTRA”, but the confirmation letter I got was printed as “LILTRA”. I don’t know what should I do to correct it… thank you Matt!

Hi Katie, usually you can write a letter to the IRS explaining the situation and showing proof of the correct. However, we only specialize in LLCs, so I’m not sure I’m answering your question as best I could. I recommend calling the IRS and asking: 800-829-4922 (option 1, option 1, option 3 to get someone). And call at 7am, 7:30, or 8am for the shortest hold time. Hope that helps.

Thank you Matt, thank you so much for your prompt reply and detailed suggestions. I’ll try to call the IRS.

You’re very welcome Katie :)

Thanks Oleksii for your Support and Matt!

I called on 18th of January and still did not receive my EIN.

The IRS told me that they can not find my Application on their database.

She suggested to call this week. But the other guy from IRS 2 weeks ago told me to resend the form SS4.

I am so confused.

I send mine on November 5 2020 I think.

It is taking forever :)

What should I do?

Hi Rocky, maybe wait another week or two and call again. Then if they still can’t find your application, then file an SS-4 again. The only reasons I say wait a little longer is that we’ve never heard of the IRS losing an application.

Little Update

I called IRS still no EIN but I will try another week or so.

What they have asked is what fax number did I use and I told them this number +1 855-215-1627.

They told me it is wrong number and I should resend again.

Hi Rocky, the 855-215-1627 fax number is their “backup” fax. However, it is best to fax it to their primary fax number listed above on the page. Thanks for your update. It’s very helpful. And sorry you are waiting so long for all this.

Great article! Thank you!

I have sent SS4 on the 2nd of November and received a reply with EIN on the 20th of January.

You’re welcome Oleksii! Thank you for the details. And thank you for your helpful comment to Rocky, too :)

Hey Matt,

I am non US citizen and in 2009 I’ve been in USA for 3 months with J1 temporary student visa. That visa gave me possibility to work so I applied for SSN. They gave me SSN number, but as it’s long time ago I cannot find the card anymore. I have 3 questions:

1- would that SSN still be valid and could be used to form LLC and file for EIN?

2- if that SSN is still valid on my name, but I don’t know or can’t find it, is there a problem if I apply for LLC and EIN without it?

3- is there a chance I could get a copy or find my SSN from the authorities, without having to go to USA?

Thanks a lot

Hi Radu, yes, the SSN is still valid and it can be used to get an EIN for your LLC. If you have the SSN number, but don’t have the SSN card, you can use the SSN number when applying for an EIN (you can actually apply for an EIN online), however, if you don’t have the number, it seems pretty difficult to get a replacement in your situation. Please see SSA: Non-U.S. Citizen/Adult — Replacement Social Security Card and SSA: Learn what documents you will need to get a Social Security Card. There won’t be a problem if you apply for the EIN for your LLC and don’t use the SSN. Hope that helps.

Yesterday i had faxed the SS4 form and certificate of formation to IRS. Only to notice i sent the certificate that is not yet been stamped by the state.

What should i do now? the fax had already sent successfully yesterday together with the certificate of formation that is without stamp. Only my signature and my registered agent’s signature in that certificate.

Hi Janine, that SS-4 application will just get rejected. When you send the fax again with the stamped and approved Certificate of Formation and SS-4, you can also include a letter letting them know about the mistake that was made with the first fax. You can include that on an additional page. It doesn’t have to be anything fancy or official. Just describe what happened, include your name and title (ex: Janine Smith, Member), and your phone number. Hope that helps.

I accidentally sent a corrupted ss4 form, and then I sent again the correct ss4 form to the IRS fax.

Do you think that will cause problems?

Hi Itay, you should be okay :)

Do you also include a copy of your government ID when faxing to IRS? otherwise how to prove your identity as the responsible party?

Hi Janine, no, you don’t need to include a coy of your government ID.

Hey Matt :)

I want to apply for the EIN by fax, but waiting time of 45 business days is not acceptable to my company, considering the fact that even after that the request may get rejected…

Is there a way to pay a premium to get the EIN faster?

Or is it legitimate to use my American friend SSN to obtain my EIN?

Hi Itay, no, there is no such thing as an expedited EIN for non-US residents. It is not legitimate to use a friend’s SSN to get your EIN. There is no other legal method besides what is presented on this page.

An amazing article with detailed information. Thanks for sharing.

God bless you.

Thank you! You’re very welcome Razzaque.

I’m non-resident alien. 3 years ago I’ve obtained EIN form IRS as a foreign individual by phone calling for selling on Amazon. I’ve now formed single member LLC in Wyoming and I need EIN for my LLC.

Should I list the EIN I’ve obtained by phone on line 7b or enter “Foreign” like the guide?

Thank you

Hi Ankush, that will most likely get rejected. While 7b does say “SSN, ITIN, or EIN”, the IRS made changes a couple years ago (see IRS May 2019 update to EIN) where you can no longer enter an EIN on SS-4. I know, it sounds funny since the form still says “SSN, ITIN, or EIN”, but the IRS didn’t update the form yet. You can try it, but I think it’s better to go with “Foreign” for line 7b. Hope that helps.

Hey Matt!

I hope you are doing well!

So here what happened.

I sent SS4 Form like 2 month ago today I found out in IRS that they do not have my form in the database.

What should I do?

Hi Rocky, the IRS is backed up and things are taking longer than usual. After 45 business days after the date you sent the SS-4, you can call to request a 147C, EIN Verification Letter (while you wait for the CP 575, EIN Confirmation Letter). It sounds like you already did that. What date did you send SS-4 to the IRS? Did you mail it or fax it?

Thanks for reply!

I sent on November 5th.

So 45 business days has passed.

I called the IRS and they told me to hold on the line while they will check the status of my document.

I sent it via Fax and I used Helloing service.

I asked them how come they do not have me in database they said try again and resend it :(

Hi Rocky, 45 business days (including holidays) from November 5th is January 15th. I’m not sure what day you called, but it might be a good idea to call again this week and see if the EIN has been processed and to see if you can get an EIN Verification Letter (147C). The IRS is generally very good about not losing applications. Let me know if you hear anything new this week.

Hello Matt,

Thank you for this superb information 👏 ❤. You are awesome!

The same thing happened to me as Rocky stated. But wanted to follow up on this.

So I applied on Nov 10 with the 45 business days it is due on Jan 21. Anyways, I contacted IRS last Friday and I received the same reply as Rocky but just decided to wait a little longer and see what happens. Reading Rocky’s comment confirms that there are a lot of us waiting for the EIN that applied in early Nov.

Rocky could you please update us if you received the EIN or applied again?

You are very welcome Yado! The IRS is really backed up. The current situation is adding large delays… and December and January are also very busy months. Please see Oleksii’s reply below. It’s really best to just wait and be patient. Sending in multiple SS-4s is not a good idea. It can cause issues. In all of my experience with the IRS, the IRS doesn’t miss documents or lose things. It just takes longer than expected sometimes. And what’s going on right now in the world has never happened before. For some people, it can take 3 months before they get the EIN number. And it’s not just non-US residents waiting. Thousands and thousands of Americans also have to apply by fax (not all EINs can be applied for online by Americans). People are waiting 2-3 months. In conclusion, it’s best to be patient and just wait until you hear back from the IRS. They will not ignore you. They will let you know if it’s approved (most all of them are) or if there are issues. Again, it’s just taking longer than expected.

Hello Matt,

I just received my EIN. FYI, I applied on Nov 10 and received it on Jan 26. So I strongly recommend applicants to be patient for 10 days or so.

Awesome. Thanks for the update Yado!

How did you sent your form? Fax or via physical mail?

Rocky, you should just wait a bit. I sent it on November 2nd and received a reply with EIN on January 21st

Hey Matt

Thank you so much for the great article!

I want to ask you if you got similar complaints regarding what PJ commented below?

Thank you

PJ Jones, December 10, 2020:

“Hi Matt, you’re a godsend. Love your mission statement and how you’re always up to date! Another foreign applicant here.

I called the IRS as you suggested (1.2 months after fax), and the agent corroborated the 45 business days and said they had released a Memo and are requiring more paperwork from foreign applicants. He said, some will get rejected if it appears they are filing the LLC to avoid taxes in their home country ( no nexus in the US). He mentioned KYC procedures, including an ITIN, which he added, you can not apply for “just to open a business bank account”. Was he scaring me, or will my application be rejected? (I added my (4) admin address in the US, but also my (5) physical address outside the US (my home). Also, will the fact that I formed in WY hold less weight than Delaware?”

Hi BM, no, this is the only time we’ve heard this. We don’t have any updates on this and I’m not sure it’s correct. If anything does change and there are any issues for non-US residents obtaining an EIN, we will update this page right away.

Hi!

The information you provided is amazing.

Thank you very much♥♥

I have a couple of questions, please help me out.

1. The fax number using which I will be faxing to IRS and IRS will fax me back,

does it need to be a toll-free number for IRS to fax me back or local number work the same?

2. If I fax the form on 10th of January 2021 and after a week I call and ask for a copy of my EIN Verification Letter (147C) from the IRS for my LLC will they give it to me( if not one week, how long should I wait)

Thank you very much.

Hi Sony, you’re very welcome! The fax number doesn’t have to be toll-free, but it does have to be a US fax number. You’ll need to wait 45 business days before calling and requesting an EIN Confirmation Letter (147C). Hope that helps :)

Thanks Matt for that great article!

It’s a bit of a bummer foreigners can’t do it online or by email. Can you use an online printing and mailing service like letterstream.com?

Hi Nick, you’re very welcome! Yes, you can certainly complete Form SS-4 and mail it to the IRS via LetterStream. Foreigners definitely can’t complete the process online. And the IRS doesn’t do anything via email, even for US citizens.

Hi Matt,

Thank you so much for sharing an excellent info really appreciated for the great effort.

I have couple of questions

1: I am canadian Citizen owned a corporation in canada ontario wanted to start Amazon business in US as per bank they required EIN number please advise me all the steps you mentioned for LLC would be the same for corporation.

2: Is there any faster way to get an EIN number either email or over the phone, please advise

3: Do I need to fill 8832 form or write 1120 instead

Thank you once again

Hi Faisal, if you are requesting an EIN for your Canadian Corporation (aka “Foreign Corporation” to the IRS), then the process is similar. You’d still complete Form SS-4, however, how you answer a few of the questions will be different. And you can actually use the IRS International Department phone line (267-941-1099) since your Foreign Corporation is applying for the EIN. It’s best to fill out SS-4 by hand to be familiar with everything, then call the IRS. They will pretty much be asking you to answer things you fill into Form SS-4.

Thank You so much Sir

Anyone got their EIN after applying around August? I mailed mine end of August ro be be shipped to a US address and have not heard back

Hi Tamanda, there is a good chance your EIN number has been approved and it just taking longer than normal to arrive back in the mail. Please see here for how to get a copy: How to get a copy of my EIN Verification Letter (147C) from the IRS?

Great content!!!

Thanks Miguel!!

You are great, great, great. I am a non-resident alien forming an LLC for e-commerce. Your guideline is just amazing. Many many thanks for your effort Matt.

Best Wishes

Burhan

You are very welcome Burhan :)

Hello Matt,

What an amazing website you had built. My congratulations to you and your team, if any, and thanks for sharing all this knowledge.

I have a quick question, what happens if a person who is not a member nor the manager of the LLC applied as the Responsible Party?

I hope you have a wonderful end of year.

Thank you.

Hi Anton, thank you! That is against the IRS rules and the correct person should file with the IRS to change the EIN Responsible Party for LLC.

Thank you very much Matt for your answer.

Happy new year!

You’re very welcome, Anton. Happy New Year!

Hi Matt,

Thank you for your info which is super useful.

I have sent the fax to IRS for an EIN, and now been waiting for their approval. However, I did not include any support documents (LLC forming documents). Will my application be rejected because of that? What should I do now?

Thank you for your advice, Mat.

Best,

Nga Le

Hi Nga, you’re very welcome. Sometimes the IRS approves the SS-4 without the LLC formation document and sometimes they reject the SS-4. It’s best to wait for a response from the IRS (instead of filing the SS-4 again).

Dear Matt,

I followed your instruction and waited for a response from the IRS. Finally my application has been approved after almost 3 months (45 business days).

The only concern is that, in the notice sent by IRS, my company name was stated as “ABC DOT COM LLC”, instead of the original one “ABC.com LLC” which was stated in the fax.

I am wondering if I should reach out to them for a correction or it is just a normal case.

Thank you for you advice, Matt.

Best Regards,

Nga Le

Hi Nga, apologies for the slow reply. We got backed up. No, you don’t need to change anything. That is complete normal. The IRS “normalizes” their data and they change “.com” to “dot com”. Hope that helps.

Hey Matt,

Thank you very much for this website, this is the most complete website I have seen on LLC’s !! You just made me save 200$ on the EIN application that Northwest Agent charges for Non-US citizens !

Do you know when the form 5472 and 1120 are due ? Do I need to fill them in if my LLC is incorporated in New Mexico (where no information needs to be reported) ?

Thanks !

Hi Anis, thank you! You are very welcome. Form 5472 and 1120 are due by April 15th each year. And yes, Form 5472 and 1120 need to be filed each year, regardless of the state in which the LLC was formed. Hope that helps.

Thanks for the swift reply Matt, you’re the best !

You’re welcome Anis!

Hi Matt – thank you for all the information on your site. I have 2 questions I’m looking for help with with respect to making investments in the US as a Canadian citizen and resident.

A) In the EIN form, if I go with the default option of having my LLC taxed as a partnership now, am I going to be able to opt for taxation as a C-Corp at a later stage?

B) Given the expected COVID led delays in getting EIN and setting up a bank account – do you know if I could simply wire the funds directly from my Canadian bank account to the investee company? The Articles of Organization for the LLC (through which I’d like to channel this investment) state I am a member/owner in this entity? Could this provide sufficient trail/reference for source of funds for IRS or any other government agency if and when they need it?

Hi Azra, we recommend speaking with an accountant, as typically, Canadians with US LLCs pay “double tax” (once to the IRS and again to the CRA). However, based on A, it sounds like you may know that ;) A) Yes, the LLC can elect C-Corp taxation at any time in the future. B) We can’t comment on specifics here, however, this likely won’t hold weight. You’d want the LLC to be sending the wire. Hope that helps.

Hola Matt, amo tu sitio, haré un donativo con la primer venta de mi LLC!

Tengo una consulta, soy extranjera no residente, tengo una LLC en Florida con mi agente registrado (Northwest) y ya presenté el SS-4

Lo que me llama la atención es que en ningún momento, ni cuando registré la LLC ni en el formulario SS4 se me pidió mi número de documento, pasaporte o información más personal. Sólo mi nombre y dirección (yo usé la del agente en todo)

Entonces, en qué momento justifico que la LLC es mía y no de alguien más con mi mismo nombre, por ejemplo?

Muchas gracias!

Hola NS, me alegra que te guste el sitio. No es necesario que dar el número de pasaporte ni ninguna otra identificación. Tu eres el miembro de la LLC (el dueño) cuando firma el Acuerdo Operativo de la LLC (aka LLC Operating Agreement) de la LLC. Yo sé que parece incorrecto, pero así es como funciona. Espero que eso to ayudas :)

Hi Matt,

Thank you so very much for such an amazing article and detailed instructions, your effort is highly appreciated. I just have a few questions:

1- I’m not a US citizen, i’m a foreigner and i live outside the US and i will form and register an LLC in the state of Wyoming, so regarding the 9b field, in the foreign country part, should i input my home country or leave it empty?

2- In the #10 field; reason for applying, started a new business then specify type, I took a look at #16 and I’m not sure under which category my business falls, i will have an e-commerce online store, drop shipping products like apparel, accessories, sporting goods…etc, so could you please help me identify my business category? is it retail or something else? please advise!

3- in the #17 field; indicate principal line of merchandise sold, what should i input there?

Thank you

Best Regards,

Mohamed

Hi Mohamed, you are very welcome :)

9b – State

You will enter “Wyoming”.

9b – Foreign country

Don’t enter anything here. Leave this blank.

(Foreign country should only be used for companies created outside of the United States).

10 – Reason for applying

Started new business (specify type) > You can enter something like “Online retail”. You don’t need to list everything.

16 – Check one box that best describes the principal activity of your business.

You can check off “Other (specify)” and enter “Online retail” again.

17 – Indicate principal line of merchandise sold, specific construction work done, products produced, or services provided.

You can enter something like “Apparel, accessories, and sporting goods”.

Hope that helps!

Hi Matt,

Thank you so very much for your answers, i really appreciate it.

God Bless

Best Regards

You’re welcome Mohamed. Thank you :)

Hi Matt,

Once again, thank you so very much for this resourceful site, it has a ton of useful information.

I have a question about the EIN, i was just having a conversation with my registered agent and they told me that the IRS only accepts mail applications right now, not fax applications and that the mail applications may take from 45 to 90 days, please verify this information.

Thank you

Hi Mohamed, you’re very welcome! The information you received is not correct. Form SS-4 can be faxed to the IRS (or it can be mailed). Right now it takes approximately 45 business days to be approved. It can be a little bit longer though due to the delays the IRS is facing at this time.

Hi Matt,

Thank you for the reply.

It’s ok, i misunderstood the conversation i had with my registered agent, the IRS does accept both fax and mail applications and yes it may take from 45 days to 90 days due to covid.

Thank you again

Hi Mohamed, you’re welcome. Glad you found the correct information :)

Hi Matt,

I just filled out the SS-4 and i have one simple question, in the end of the form, the signature and date fields, they are not editable fields where i can type them on the computer, so do you mean print out the form after filling it out then write the signature and the date fields by hand? please advise

Thank you

Best Regards,

Mohamed

Hi Mohamed, yes, you can print the form out, sign it, and then scan it. The IRS doesn’t accept “digital” signatures.

I want to know if can use my ein number to get an identification card

Hi Chukwuemeka, no, the EIN is not used to get an ID.

I am a Nigerian presently in Virginia and I am wondering if I can get ein number by filling the SS4 form or not

Hello, yes, you can get an EIN by filing Form SS-4. The instructions are above on this page.

Hey Matt!

I need your advice :)

I sent SS4 form via Fax (Hellofax) and forgot to write down my Fax number :)

What should I do?

Thank you!

Hi Rocky, we recommend calling the IRS and requesting an EIN Verification Letter (147C). Hope that helps.

Hello Matt and thanks for your job.

I have found some people who get their EIN through fiverr in just 2 or 3 days for 15/20 dollars.

What do you think about this method?

Isn’t it risky to give our information like that?

Thank you.

Thanks Michel! I think this sounds absolutely crazy! We don’t recommend any such thing. Furthermore, there is absolutely no way a non-US resident (who doesn’t have an SSN or ITIN) can get an EIN in 2-3 days. Hope that helps :)