Note: This article is written for people forming an LLC (Limited Liability Company) in the United States and who need to get an EIN from the IRS. Understanding Taxpayer ID Numbers is foundational information you need to properly understand our EIN lessons. Please note: We are only discussing the TIN, SSN, EIN, and ITIN. We are not discussing the ATIN (Adoption Taxpayer Identification Number) and PTIN (Preparer Tax Identification Number).

Don't have an LLC yet? Hire Northwest to form your LLC for $39 + state fee (then add EIN to your order).

Have an LLC, but no EIN? Hire Northwest to get your EIN:

I have an SSN | I don't have an SSN

EIN vs. TIN (Taxpayer ID Number)?

EIN vs. ITIN?

EIN vs. FEIN?

What’s the difference between all these acronyms?

In order to best understand the difference, we first need to understand the term TIN, or Taxpayer ID Number.

What is a Taxpayer ID Number (TIN)?

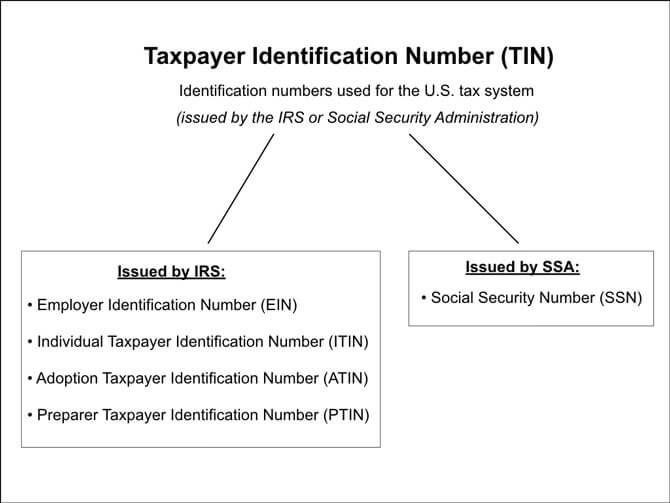

A United States Taxpayer ID Number (TIN) is issued by either the Internal Revenue Service (IRS) or the Social Security Administration (SSA). TINs are used to govern and administer US tax laws as well as perform other functions.

There are various types of Taxpayer ID Numbers (TINs), so a TIN in and of itself is not a number.

The Social Security Number (SSN) is the only TIN that is issued by the Social Security Administration. All other TINs are issued by the IRS.

Tip: Think of a TIN as an “umbrella term” for housing the SSN, EIN, and ITIN.

Do I need a TIN?

A TIN must be used on tax returns, statements, and other tax documents, so yes, when dealing with the IRS, you must have some form of a TIN.

The 3 types of TINs (that we’ll discuss) used by individuals and businesses are:

- Social Security Number (SSN)

- Employer Identification Number (EIN)

- Individual Taxpayer Identification Number (ITIN)

A Social Security Number (SSN) is issued by the Social Security Administration (SSA) to identify an individual person, such as a US Citizen, Permanent Resident, or Temporary Nonimmigrant Worker.

Initially, the SSN was used as a way to keep track of earnings for those who worked jobs covered by the Social Security program.

However, after Executive Order 9397 was signed in 1943, the SSN began being used by federal agencies as a way to keep accurate records for individuals. They realized nearly 70 million Americans already have this number, so making them more widespread was convenient and effective. As computers became more powerful in the 1960s and more legislation was passed, the SSN became somewhat of a “national identification number”.

Most people think of using an SSN for filing and reporting taxes with the IRS, but the SSN is also used for:

- individual bank accounts, loans, and securities

- US passports

- federal benefits

- Medicare

- federal loans

- motor vehicle registration

- voter registration

- and much more

Format: A Social Security Number is a series of 9 numbers formatted like xxx-xx-xxxx. Historically, the first 3 digits of the number represent what geographical area you were born in, but since June 25, 2011, the IRS no longer uses that approach in assigning new numbers and instead uses a randomized system that has no geographical identifier.

Who is eligible for an SSN?

- US Citizen: A person with specific rights, benefits, duties, and responsibilities under the Constitution and government of the United States. Such benefits include the right to vote, travel with a US passport, bring family to the US, apply for federal jobs, and other government benefits.

- Permanent Resident: A person who is allowed to live and work permanently in the United States. They have a lot of rights and benefits, but not as many as US citizens.

- A Permanent Resident is also referred to as:

- Permanent Resident Alien

- Green Card Holder

- Lawful Permanent Resident

- Resident Alien Permit Holder

- A Permanent Resident is also referred to as:

- Temporary Nonimmigrant Worker: A person who has permanent residency outside of the United States, but is temporarily visiting the United States for common reasons, such as work, study, and business. They have some rights and benefits, but not as many as Permanent Residents and US Citizens. This person also needs authorization from the Department of Homeland Security (DHS) to work in the United States.

How to get an SSN?

If you are eligible for an SSN, you can apply in one of two ways:

1. If you are an immigrant, you’ll need to apply for your SSN in your home country (at a Social Security Field Office). You can apply for an SSN at the same time you apply for your Immigrant Visa.

Here are some instructions:

Social Security Numbers and Immigrant Visas

Foreign Workers and Social Security Numbers

How to find a Social Security Field Office:

About Foreign Social Security Field Offices

List of Offices Outside the US

2. If you are not an immigrant, you must visit a Social Security Office within the United States. It’s best to wait at least 10 days after your arrival in the US to make sure your approval with the Department of Homeland Security is in the system.

How to find a Social Security Office in the United States:

Social Security Office Locator

EIN (Employer Identification Number)

An EIN is a unique 9-digit number issued by the IRS to persons or entities doing business in the United States for purposes of identification. It is also known as Federal Employer Identification Number or Federal Tax Identification Number.

Although an EIN is most often used to identify a company (such as an LLC) with the IRS, it’s also needed to open a business bank account, apply for business licenses and permits, do business with other companies, and handle payroll for employees (if applicable).

Format: An EIN is a series of 9 numbers formatted like xx-xxxxxxx.

How to get an EIN for an LLC?

There are two ways to get an EIN for your LLC.

1. If you have an SSN or ITIN, you can apply online with the IRS through the EIN Online Application. Instructions are below.

2. If you don’t have an SSN or an ITIN, don’t worry, you can still apply for an EIN with the IRS, you just can’t do it online. Instead, you’ll need to mail or fax Form SS-4 to the IRS. Links to the instructions are below.

Note: Approximately half of the people who have an ITIN and use it during the online filing get rejected. There are various reasons ITIN holders get rejected in the online application. It’s a not a big deal though, so we recommend trying to obtain your EIN online if you have an ITIN, and then if you get rejected, just mail or fax Form SS-4.

Follow one of our lessons below:

- Apply for EIN using Online Application (if you have an SSN or ITIN)

- Apply for EIN with Form SS-4 (if you apply online but get an error message)

- Foreigners applying for EIN (if you don’t have an SSN or ITIN)

Note: If you’re looking for information about getting an EIN for another type of business besides an LLC, we apologize, but currently, we only have instructions on how to obtain an EIN for an LLC.

ITIN (Individual Taxpayer Identification Number)

An ITIN is issued by the IRS to persons (both residents and nonresidents of the US) who are not eligible for an SSN, but still need to file taxes and reports with the IRS.

Format: An ITIN is formatted like a Social Security Number, except that it always starts with the number 9. For example, 9xx-xx-xxxx.

Note: You do not need to have an ITIN in order to get an EIN for your LLC. If you follow our lessons above for how to obtain an EIN, we’ll show you how to get one without an SSN or ITIN. However, you will eventually need to get an ITIN if you have an obligation to pay and/or report US taxes.

How to get an ITIN?

You must complete Form W-7 in order to apply for an ITIN. For instructions, please follow this lesson: How to apply for an ITIN.

Frequently Asked Questions: TIN, EIN, ITIN, and More

EIN vs TIN: What’s the difference?

An EIN is used by the IRS to identify a business, such as an LLC.

A TIN is an umbrella term which includes the EIN (and the SSN and ITIN as well).

Said another way, think of the TIN as the “parent” and the “EIN” as the child.

An EIN is a type of TIN, but a TIN is not a type of EIN.

Are an EIN and FEIN the same thing?

Yes, an EIN and FEIN are the same exact thing.

The EIN is an abbreviation for Employer Identification Number. FEIN is an abbreviation for Federal Employer Identification Number.

Other synonyms include Federal Tax ID Number (FTIN) and Federal EIN Number.

EIN vs ITIN: what’s the difference?

As mentioned above, an EIN is used by the IRS to identify a business, such as an LLC.

EIN stands for Employer Identification Number (but you’re not required to have employees).

ITIN stands for Individual Taxpayer ID Number and is used by people who must file a US tax return, but are not eligible to get an SSN (Social Security Number).

If you need to get an ITIN, please follow this lesson: How to apply for an ITIN.

EIN vs SSN: when to use which one?

If you’re operating as a Sole Proprietorship (and not forming an LLC), then you’ll just use your SSN with the IRS for tax purposes and with the bank to open an individual account.

If you form an LLC, then you’d use your EIN with the IRS for tax purposes and with the bank to open a business account.

Note: If you’re a Single-member LLC (which by default, is taxed by the IRS as a Sole Proprietorship) you can use either your SSN or your EIN, although most people prefer to get an EIN and give that out instead of their SSN for privacy reasons.

Do I Need an EIN for an LLC?

You don’t “have to” get an EIN for an LLC (if you’re a Single-member LLC), but you will need an EIN to open a bank account, apply for business licenses, get business credit cards, and more. So in summary, you don’t have to get one, but you should.

If you form a Multi-member LLC, then yes, you’ll need an EIN to file tax returns with the IRS and to open a business bank account.

EIN without SSN: How to get an EIN if you don’t have a Social Security Number?

In order to get an EIN without an SSN, you’ll use the Form SS-4. You won’t be able to use the EIN Online Application, which is only recommended for those who have an SSN.

Instructions: Please follow our apply for EIN without SSN or ITIN lesson and we’ll walk you through how to mail or fax Form SS-4 to the IRS.

Here is the biggest challenge foreigners face when getting an EIN: Line 7b (where it asks for EIN, SSN, ITIN).

- If you have an ITIN, you’ll enter that on line 7b.

- If you don’t have an ITIN, you’ll enter “Foreign” on line 7b.

Summary

There are a lot of acronyms throughout this lesson and things can get confusing. We recommend reading this article twice to get a clear understanding of the terms.

In summary, the “umbrella term” TIN stands for Taxpayer Identification Number and includes:

• SSN (Social Security Number)

• EIN (Employer Identification Number)

• ITIN (Individual Taxpayer Identification Number)

Each number has different uses and is applied for in a different way.

References

26 US Code 6109

26 US Code 301.6109-1

TIN vs EIN Information

SSA: About the Numbering System

SSA: The Story of the Social Security Number

IRS: How are EINs assigned and valid EIN prefixes

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

If you have a Nonprofit Organization but don’t get paid. Do you still have to report it to the Social Security Office if you are Disabled.

We don’t work with non-profits so you’ll need to check with an accountant or two on this. Thank you for your understanding.

What if received a 1099K they used Social Security number instead of EI in what W9 form do you use to correct this mistake

Hi Valerie, it sounds like you have a Single-Member LLC taxed as a Sole Proprietorship. The IRS doesn’t really care. You can still report the income on the Schedule C for your LLC. Hope that helps.

Hello Matt!

First, let me just say that your website has been resourceful. I’ve learned more than I ever could elsewhere, and I’d gladly recommend your blog to anyone else out there.

I have two questions that I’d appreciate answers to.

Before that, let me give some background. I’m not a US citizen or a US resident. I’ve done some content development for some of my clients based in the US, and I realize I have a tax responsibility because they haven’t been withholding tax on my behalf. Also, in the next few weeks I’ll open a business in Wyoming, and I intend to sell products across the US. I do not have an ITIN or an EIN (yet).

1. As a content developer, do I get an ITIN or an EIN?

2. Once I get an ITIN, can I file my business taxes using it or will I have to use an EIN?

3. What’s the upside and/or downside of having both?

Hi Derrick! Thank you very much. I’m very happy to hear that. You need both. Or more accurately, your LLC needs an EIN and you need an ITIN. The EIN is used by the LLC to open an LLC bank account (see How a non-US resident can open a bank account for a US LLC) and for filing tax documents. The ITIN is needed if you have a US tax filing responsibility (see How to apply for an ITIN).

The following pages will also be helpful:

Get an EIN for LLC without SSN

Form 5472 for foreign-owned Single-Member LLC

Hi Matt,

Thanks for the information!

I have foreign-owned single-member LLC and I have an EIN. Do I still need an ITIN then?

Hi Adrian, you need an ITIN if you have a US income tax filing obligation. You’ll also need to file Form 5472 each year. Please see here: foreign-owned LLC Form 5472. Hope that helps.

I’m starting up a new Single-Member LLC in Colorado. I understand that Single-Member LLC’s do not necessarily require an FEIN. However, If I decide to get one, does it change or complicate how tax filings are done? Without one, I know it can all be done under one filing with an SSN. With a separate FEIN, does that change? Thanks for all the great information on your site!

Hey Craig, you’re welcome :) No, getting an EIN doesn’t change or complicate how taxes are done. Well, technically, only very minor. As in, instead of using your SSN, you’d use the EIN. Reading how is an LLC taxed may also help.

I appreciate your service. Great information! Thank you.