Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through starting a Kentucky LLC by filing your Articles of Organization. This document is filed with the Business Services Division of the Kentucky Secretary of State.

The Articles of Organization is the document that officially forms your Kentucky LLC.

You can file your Kentucky LLC Articles of Organization by mail or online.

Kentucky LLC filing fee

The filing fee for an LLC in Kentucky is $40. This is a one-time fee.

The $40 LLC fee is the same for both the online filing and mail filing.

Note: The “LLC filing fee” (the fee to create a Kentucky LLC) is the same thing as the “Articles of Organization fee”. The Articles of Organization is the document that, once approved by the Secretary of State’s office, creates your Kentucky LLC.

How long does it take to get a Kentucky LLC?

Online filing:

Kentucky LLCs are approved immediately if you file online. But if you file on the weekend (or after business hours), it will likely be approved on the next business day.

Mail filing:

Kentucky LLC approval time is 1 business day (plus mail time) if you file by mail.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Kentucky.

How to file a Kentucky LLC

LLC University® recommendation

We recommend filing online as the approval time is faster.

You can file this yourself or you can hire a company to do this for you. Check out Best LLC Services in Kentucky for our recommendations.

(Kentucky Secretary of State, Business Filings Building)

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Instructions for Filing Kentucky Articles of Organization Online

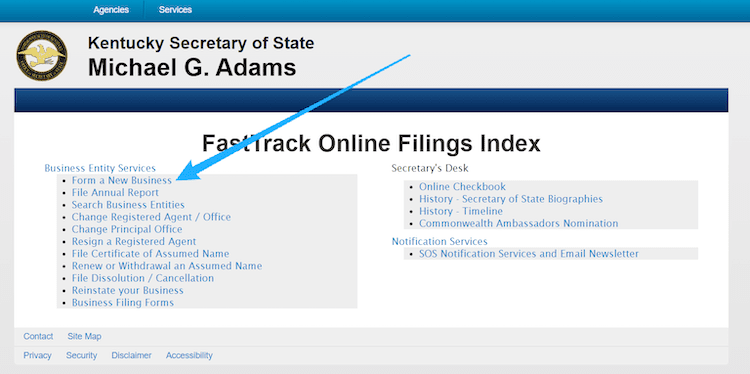

The Kentucky Secretary of State has a simple online filing system called FastTrack. You don’t need to register for an account or login.

Just go to the FastTrack Online Filings Index page to get started.

Next, click “Form a New Business”

Where is the business located?

This page is asking whether you’re forming a Domestic LLC (a Kentucky LLC) or registering a Foreign LLC (that was formed in another state).

Select “Kentucky“.

Please select the entity type

Click “Limited Liability Company (profit, non-profit, professional)”

Form a New Limited Liability Company

Choose the type of LLC you are filing

“Profit” is automatically selected.

Most LLCs are for-profit. If you choose non-profit or professional, you will need additional documents (non-profit certification, or the professional license/certificate).

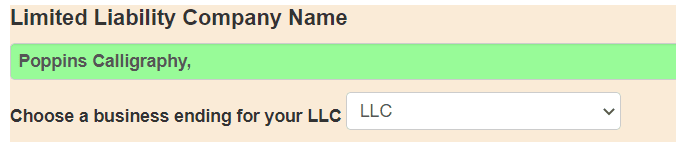

Limited Liability Company Name

- Prior lesson: Make sure you have read the Kentucky LLC name search lesson before proceeding. We have some tips on how to make sure your LLC name is available.

Enter your desired LLC name exactly how you want it. Don’t include the designator (LLC, L.L.C., Limited Liability Company, etc.) when you type the name in this field.

Instead, select your preferred designator from the dropdown menu labeled “Choose a business ending for your LLC“. If you’re having trouble making a selection, “LLC” is the most common.

Comma in LLC name:

You can use a comma in your Kentucky LLC name or you can leave it out.

For example, “Poppins Calligraphy, LLC” and “Poppins Calligraphy LLC” are both acceptable. If you want to use a comma, make sure to include the comma in the Limited Liability Company Name field:

Entities Email

Enter an email address for your company. This could be your personal email address, or a business email address.

We recommend entering an email address here. This information will not go on public record. The state keeps it private.

Management Type

- Related article: Make sure you have read Member-managed vs Manager-managed LLC before proceeding. The LLC management type will also be specified in your Kentucky Operating Agreement.

Select whether your LLC is Member-managed or Manager-managed.

What do most people choose? Most Kentucky LLCs are Member-managed, where all the LLC Members take part in running the business and all the Members can legally bind the LLC.

Veteran-owned (Free LLC)

Thanks to the Boots to Business program, if your LLC is majority owned (51% or more LLC membership interest) by a military veteran or active-duty service member, your LLC filing is free ($0). This program is available to members of the National Guard, too. Learn more about Free LLCs for Kentucky Veterans.

If you’re forming a veteran-owned Kentucky LLC, check the box for “This LLC is veteran-owned“.

Principal Office

Enter an address for your LLC’s principal office.

This address is where the Kentucky Secretary of State will send correspondence to your LLC.

Your LLC’s principal office address:

- doesn’t have to be in Kentucky; it can be located in any state

- can’t be a PO Box address

- doesn’t have to be an actual office building

- can be a home address

- can be a friend or family member’s address

- can be the address of your Kentucky Registered Agent, if allowed

Effective Date

- Related article: Please take a look at LLC effective date before proceeding. If you’re forming your Kentucky LLC later in the year (October, November, or December), you may want to forward-date your filing to January.

Most people use the date they’re filing the Articles of Organization. That means your LLC goes into effect on the day it’s approved by the Secretary of State.

Signatures of Organizers

- Related articles: LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer.

Enter the name and title of the person submitting the FastTrack Articles of Organization filing. Make sure to click the “Add Organizer” button.

What title should I use?

- If you are one of the LLC owners, enter “Member“.

- If you are an LLC manager, enter “Manager“.

- If you are an LLC owner who is also an LLC manager, enter “Managing Member“.

- If you aren’t an LLC member or manager but are authorized to file the Articles of Organization on the LLC’s behalf, enter “Organizer“.

Registered Agent/Office

- Prior lesson: Make sure you have read the Kentucky LLC Registered Agent lesson before proceeding. We have some tips on keeping your address off of public records. And explore our article on Is a Registered Agent a Member of an LLC?

First, select “Individual” or “Entity“. Then, enter the name and address of your LLC Registered Agent.

If you hired a Registered Agent company:

Select the button for “Entity“.

If you hired Northwest Registered Agent:

- Login to your Northwest account and look for their Kentucky address

- For “Name”, enter: Northwest Registered Agent LLC

- If email is needed, use support@northwestregisteredagent.com

If you hired a different Registered Agent company, you’ll need to contact them regarding how to complete this section (and whose name to use for Signature of Registered Agent below).

If you, a business partner, or a friend or family member are the Registered Agent:

Select the button for “Individual”.

Enter their name and address. This must be a physical street address in Kentucky. You can’t use a PO Box.

Signature of Registered Agent

If you hired a Registered Agent company:

Enter the name of the company’s authorized representative. For Northwest, that would be “Taylor Newman”. If you hired another company, contact them for information on how to complete this section.

If you, a business partner, or a friend or family member are the Registered Agent:

Enter the person’s name. The name entered here must match the name you entered for the Individual Registered Agent above.

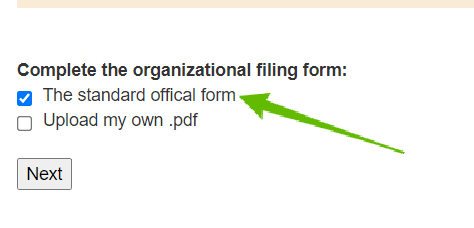

Complete the organizational filing form

This question asks whether you’re using the state’s standard Articles of Organization or custom Articles of Organization.

Most people don’t need – or use – a custom Articles of Organization. So you can just select the first option (“The standard official form”).

Click “Next” to proceed.

Click “Next” to proceed.

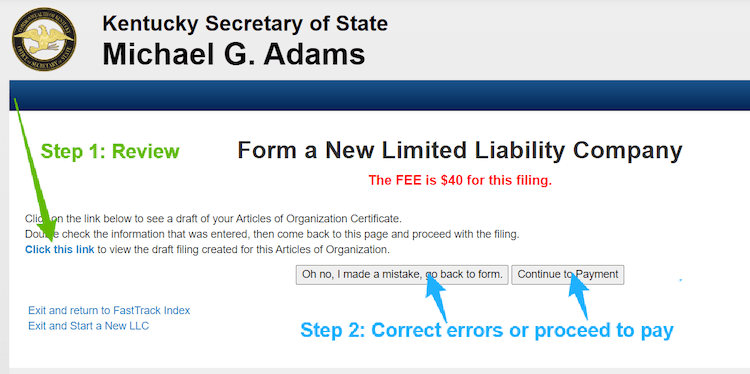

Review

To review the information you submitted, click the link to open a PDF in a new tab. Review the information in the PDF document and look for any typos..

If you need to make any changes, click the “Made a mistake” button to go back.

If all looks good, click the “Continue to Payment” button to proceed.

Payment

Enter your billing information, then submit your payment to the state.

Congratulations! Your Kentucky LLC has been filed for processing.

Now you just need to wait for approval.

How long does it take to get a Kentucky LLC approved?

If you filed your Kentucky LLC online, it will be approved immediately (except if it’s the weekend). Once it’s approved, the state will send you an email.

Tip: We recommend saving a few copies (both physical and digital) and keeping them with your business records.

After your LLC is approved, you can draft your LLC Operating Agreement and open a business bank account.

Required: Record Articles of Organization with the County Clerk

Kentucky law requires you to record a copy of your Articles of Organization.

This needs to be recorded with the County Clerk’s office in the same county where your Registered Agent is located.

The recording fees are usually between $9 – $15. But you’ll need to call the County Clerk and verify the details.

Ask to speak to the “recording department”, find out the recording fees, and get detailed instructions on how to send your approved Articles of Organization.

Kentucky Secretary of State Contact Info

If you have any questions, you can contact the Kentucky Secretary of State at 502-564-3490.

Their hours are Monday through Friday, from 8am – 4:30pm.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Kentucky Filing Forms FAQs

How much does a Kentucky LLC cost?

It costs $40 to form a Kentucky LLC. This fee is the same whether you file your LLC online or by mail.

The $40 fee is for the Kentucky LLC Articles of Organization, the document that creates your LLC. It’s a one-time fee paid to the Kentucky Secretary of State.

Note: Veterans can file their LLC for free.

Learn more about all the Kentucky LLC Costs.

How do I file the Kentucky Articles of Organization?

You can file the Kentucky Articles of Organization online or by mail. We recommend filing online (using the FastTrack system) because it’s easier and has a faster approval time. The state will also email you your LLC approval documents.

If you prefer to file by mail, the approval time takes a bit longer. And you’ll need to go online to download your LLC approval documents.

Can I file the Kentucky LLC Articles of Organization by mail?

Yes, you can file the Kentucky LLC Articles of Organization by mail (instead of filing online).

If you do, the instructions above still apply and help you complete the form.

Here’s how to file your LLC paperwork by mail:

- Download Form KLC-1 (Kentucky Articles of Organization – Limited Liability Company)

- Prepare a check or money order for $40 (payable to “Kentucky State Treasurer”)

- Mail the completed Articles of Organization and payment to:

Secretary of State

PO Box 718

Frankfort, KY 40602

Approval:

If you filed your Kentucky LLC by mail, it will be approved in 1 business day (plus mail time). Once it’s approved, the state will mail you a postcard.

Once you receive your approval notice, you can download your approved Articles of Organization online:

- Search your LLC on the Kentucky Business Entity Search

- Scroll down to “Images available online“

- Click “Articles of Organization” and download/save a copy to your computer

Tip: We recommend saving a few copies (both physical and digital) and keeping them with your business records.

Don’t forget: Once you receive your approved Articles of Organization back in the mail, you should record them with the County Clerk.

Should I use Kentucky FastTrack or Kentucky OneStop?

Kentucky has two filing systems for LLC formation online: FastTrack and OneStop.

FastTrack is an easy-to-use online filing system built by the Kentucky Secretary of State.

OneStop is a multi-department registration process used by the Secretary of State and the Department of Revenue. While it was built with good intentions, it’s really complicated and has disadvantages.

We don’t recommend OneStop. It asks for a lot of extra information and can be confusing. There isn’t good customer support for OneStop either, since it’s shared by several departments.

We have step-by-step instructions above on how to file using FastTrack.

References

Kentucky Secretary of State: Fees

Kentucky Secretary of State: Laws

Kentucky Revised Statutes: Section 275.020

Kentucky Revised Statutes: Section 275.025

Kentucky Revised Statutes: Section 274.045

Kentucky General Assembly: House Bill 367

Kentucky Secretary of State: Business Filings

Kentucky Revised Statutes: Section 14A.2-070

Kentucky Revised Statutes: Section 14A.2-040

U.S. Small Business Administration: Boots to Business

Kentucky General Assembly: Kentucky Revised Statutes

Kentucky Secretary of State: Frequently asked questions

Kentucky General Assembly: Overview of House Bill 367

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Kentucky LLC Guide

Looking for an overview? See Kentucky LLC

I filed my llc (that I own with a partner) articles of organization with the state of Ky. It doesn’t list both of our names on the articles of organization(you can only add one name) but does specify that it will be managed by members. We do have a LLC operating agreement that indicates we are equal owners. A tax professional mentioned that we filed our articles wrong and because of the way it’s set up (only one person’s name is on the articles of organization), the business taxes can only be filed by the person who is listed and we both won’t use the K-1 form for our personal taxes. Is the tax preparer correct?

Hi Lee, LLC Members are not listed in the Kentucky LLC Articles of Organization. You/they are probably confusing the LLC Organizer name with meaning they are a Member. I think you received incorrect information. It’s likely worth interviewing a few accountants.

I just recently opened a llc and was wondering how to change it from single member to multi member.

Hi Eric, it may be easier to dissolve/cancel this LLC and form a new one. To add another LLC Member, you’d first need to transfer some of your LLC membership interest to them. This can be done via an Assignment of LLC Membership Interest (we don’t provide this form at this time). Then you’d want to amend the Kentucky LLC Operating Agreement. Then you’ll need to file Form 8832 with the IRS to change the tax classification from LLC taxed as Sole Proprietorship to LLC taxed as Partnership. You’ll also need to contact the Kentucky Department of Revenue to see if they require anything. And visit the bank to add the new Member to the LLC bank account. Hope that helps.

I have had my own business in Kentucky since 2004. I am now wanting to convert it to an LLC. What do I have to do different or in addition to what I would do if I were just starting the business?

Hi Vestina, if you have a Sole Proprietorship, you can simply form a new LLC. We have a page on changing over from a Sole Proprietorship to an LLC: change from Sole Proprietor to LLC. Hope that helps.

I registered as a single member operated LLC with the state of Kentucky and was sent an approval message in the OneSTop Portal. Now to Apply for the EIN number. Should I select S Corportaion? Is this an option with a single member LLC?

Hi Lisa, you should not select S-Corporation when obtaining your EIN since you have not elected S-Corporation at this time. Also, if you’re just starting out, it’ll likely cost you more in administrative, payroll, bookkeeping, and accounting costs that any benefits of an LLC taxed as an S-Corporation. Usually it takes around $70,000 in net income for the LLC taxed as an S-Corp to be worth. I recommend following our EIN tutorial lesson in addition to reading LLC taxed as S-Corp and how are LLCs taxed. Hope that helps!