Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through filing your Articles of Organization with the Tennessee Secretary of State.

This is the document that officially forms your Tennessee LLC.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Tennessee LLC Filing Fee

How much a Tennessee LLC costs will depend on how many LLC Members (owners) there are.

1-6 Members

If your LLC has between 1 and 6 Members, your LLC filing fee is $300.

For example:

- If you have 2 Members, your filing fee is $300.

- If you have 6 Members, your filing fee is $300.

More than 6 Members

If your LLC has more than 6 Members, you will add an additional $50 per member (on top of the $300) for each Member over 6.

For example:

- If you have 7 Members, your filing fee is $350 ($300 + $50).

- If you have 10 members, your filing fee is $500 ($300 + $50 + $50 + $50 + $50).

Note: The “LLC filing fee” (the fee to create Tennessee Limited Liability Companies) is the same thing as the “Articles of Organization fee”. The Articles of Organization is the document that, once approved by the Secretary of State’s office, creates your Tennessee LLC.

How much is an LLC in Tennessee explains all the fees you’ll pay, including the Articles of Organization filing fee.

(Tennessee Secretary of State, Business Services)

Tennessee Limited Liability Company Approval Time

The approval time for an LLC in Tennessee varies depending on how you file:

- If you file by mail, your LLC will be approved in 3-5 business days (plus mail time).

- If you file online, your LLC will be approved immediately.

LLC University® recommendation: We recommend filing your Tennessee Articles of Organization online. This is because it’s easier and has a faster approval time. Instructions for online filing are below.

However, if you aren’t very tech-comfortable, you can still file by mail.

You can file the LLC paperwork yourself or you can hire a company to do it for you. Check out Best LLC Services in Tennessee for our recommendations.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Tennessee.

How to file a Tennessee LLC Online

Get started:

Visit the Tennessee Secretary of State Business Services Online.

Note: You don’t need to create an account to use the Business Services Online system. Simply click the Start button to begin your filing.

This page will walk you through filing the Tennessee Articles of Organization. Just follow along with our step-by-step instructions below.

Or if you’d rather watch a video guide, we walk you through the process here:

Form or Register a New Business

Business Entity Type

Select “Limited Liability Company” from the dropdown menu.

I attest that:

Click the box here to confirm that you understand business filings are public record.

Name

First, make sure your business name follows Tennessee statutory requirements. We explain the rules and how to check if your name is available in our article: Tennessee LLC Name Search.

Business Name

Business Entity Name

Enter (and confirm on the next line) your desired LLC name.

Make sure to include a permitted designator. In Tennessee, you can use the following:

- LLC (most common)

- L.L.C.

- Limited Liability Company

You can use a comma in your LLC name or you can leave it out. For example: Grand Olive Oil LLC and Grand Olive Oil, LLC are both acceptable.

Formation Locale

Select “Domestic Tennessee Business” to form a Tennessee LLC.

Business Type

Additional Designation

Most people are forming regular LLCs, and leave this set to “(none)“.

If you are starting a Non-Profit or a Professional LLC (PLLC), select that option instead. You’ll need extra documents (like non-profit certification or proof that you’re a licensed professional) if these apply to you.

Series LLC

A Series LLC works like a network of connected companies. However, they are much more complex. These are uncommon, and most people don’t check this box.

Click “Continue” to proceed.

Detail

Business Entity Properties

Period of Duration

In this section, you’ll tell Tennessee how long you want your LLC to exist.

We recommend leaving the dropdown menu on “Perpetual“.

This gives your LLC a perpetual (aka permanent) duration. This means your LLC will exist forever, until you choose to dissolve it.

Note: It’s very rare to specify an end date in your Articles of Organization filing (a date on which your LLC would automatically shut down). You can always dissolve your LLC by filing a simple form later.

Expiration Date

If you chose a duration that Expires, you’ll enter a date here. Otherwise, there’s nothing to do here.

Fiscal Year Close

For accounting and tax purposes, most small businesses run on the “calendar year”, which is January 1st to December 31st. That’s the same as your personal income taxes.

If that’s what you will be doing for your LLC, you can leave this set to “December” for your LLC’s fiscal year. (This is what most people do).

If your business runs on a different fiscal year, please enter that fiscal year end date instead.

Delayed Effective Date

- Learn More: What is the LLC Effective Date?

The LLC Effective Date is the date your LLC goes into existence. Think of it like the day your LLC is “born”.

If you don’t declare a Delayed Effective Date, your LLC will become effective the day it is approved by the Tennessee Secretary of State.

If you want your LLC to go into existence on the date it’s approved by the state:

Then you don’t need to do anything here. Most people choose this option.

If you want your LLC to go into existence on a future date:

Click “Declare a Delayed Effective Date” and enter that date (ex: MM/DD/YYYY). This date can’t be more than 90 days ahead. And you can’t back-date your filing.

Pro Tip: If you’re forming your Tennessee LLC later in the year (October, November, December) and you don’t need your LLC open right away, you can give your LLC an effective date of January 1st of the following year. This can save you the hassle of filing taxes for those few months with no business activity.

Managed By:

- Learn More: Member-managed vs Manager-managed LLC

Choose from the dropdown menu:

- Director Managed

- Managed Managed

- Member Managed

Tip: Most people’s LLCs are either Manager-managed or Member-managed. Director-managed is not very common and most people don’t use this. Director-managed is like having a board of directors to run your LLC.

Number of Members

- Learn More: Who can be LLC Members?

Enter (and confirm in the next line) the number of Members in your LLC.

Remember, the filing fee in Tennessee depends on the number of Members in your company. Make sure this is accurate.

Obligated Member Entity

Don’t check this box.

Other Provisions

Don’t check these boxes (unless your attorney instructed you to).

Click “Continue” to proceed.

Agent (Registered Agent)

Agent Detail

- Learn More:

If your LLC will be its own Registered Agent:

Check the box at the top for “This business entity will represent itself”.

If your Registered Agent will be another company, or a person:

Under Agent Type, select “Individual” or “Organization”

- If you or someone you know (friend or family member) will be the Registered Agent, select Individual.

- If you hired a Registered Agent Service, select Organization.

If your Registered Agent is an Individual:

Enter their first name, last name and address. The address must be in Kentucky and cannot be a PO Box.

Note about addresses: When you enter addresses in the Business Services Online system, it checks the address against the USPS database. After clicking Continue, the page might refresh and you might see a message saying “Address Validation Result”. Please review for accuracy and make corrections if needed then select “Continue”. Check to make sure the new address (usually changing “Street” to “St” or other minor changes) is still accurate. Then click “Continue” again to proceed.

If your Registered Agent is an Organization:

Enter the company’s Secretary of State Control Number (SOS Control #).

Once you enter the SOS Control #, the system will automatically complete the business name and address.

Note: If you hired Northwest Registered Agent, their Tennessee SOS Control Number is 000593933.

How to find the SOS Control #

Option 1: Call the Registered Agent Service you hired and ask them for their Tennessee SOS Control #.

Option 2: Go to the Tennessee Business Entity Search. Enter the name of your Registered Agent Service. Find your Registered Agent in the list, and look at the Control # column.

Click “Continue” to proceed.

Address

Principal Office Address

Enter your LLC’s Principal Office Address. This address can be any state, or in any country.

Phone: You can enter your phone number if you want, but this is optional, so you can leave it blank.

Email: Enter an email address so the Secretary of State can send you reminders about the Tennessee LLC Annual Report. Every Tennessee LLC must file Annual Reports every year, so this is a helpful service.

If the Principal Office and Mailing Address are the same, check the box.

Mailing Address

If your LLC’s Mailing Address is different from your Principal Office Address, then you can enter it here. This address can be in any state, or in any country.

Click “Continue” to proceed.

Confirmation

Review the information you entered, and check for any typos.

If you need to make any changes, go back and do so. If all looks good, click “Continue” to proceed.

Signature (LLC Organizer)

- Learn More: LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer

On this page you’ll identify the LLC Organizer and electronically sign your filing.

Click the box for “I certify” to confirm the information you entered is accurate. And to confirm that you’re authorized to file the LLC documents.

Name

Enter the Organizer’s first and last name.

“I am acting as an Authorized Representative”

Check this box if you are the LLC Organizer (if you’re filling out this form) but you aren’t an LLC Member or Manager. For most people, who are forming their own LLC, this doesn’t apply and they won’t check the box. But if you are filing the paperwork for a friend, for example, you would check this box to confirm you’re filing on the LLC’s behalf. If you click the box, the system will ask you to enter the name of the person who authorized you to file (the friend who owns the LLC, for example). If you click the box for “Authorized Representative,” you should enter “Organizer” under Signer’s Capacity below.

Signer’s Capacity

- If you are an LLC Member (owner), enter “Member“.

- If you are an LLC Member and a Manager, enter “Managing Member“.

- If you are an LLC Manager but not a Member, enter “Manager“.

- If you are acting as an Authorized Representative and checked the box above, enter “Organizer“

Basically: Whoever can sign contracts on the LLC’s behalf can sign this filing.

Note: If these terms are confusing, check out LLC Officer Titles for more information. One person can hold multiple offices (like a Managing Member).

Phone and Email Address

You must enter both a phone number and an email address. The Secretary of State may use this to contact you if they have any questions.

Click “Continue” to proceed.

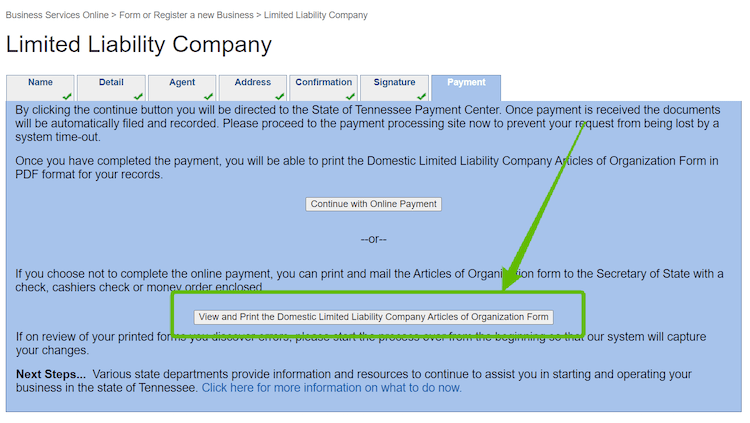

Payment

Click the button to Continue with Online Payment.

Enter your credit card or debit card details and submit your payment to the state.

Congratulations! Your Tennessee LLC has been filed with the Secretary of State.

Tennessee LLC Approval – Online FIling

When submitting documents online, your LLC will be approved immediately.

When you finish and pay online, you’ll be able to print your approved Articles of Organization and Acknowledgment Letter in PDF format.

We recommend keeping a copy of your approved Articles of Organization and Acknowledgment Letter with your other LLC documents. Maintaining corporate records is an important part of running a business.

Required: Record Articles of Organization with the County Register of Deeds

Tennessee requires you to record a copy of your Articles of Organization with your Register of Deeds office.

This needs to be recorded with the Register of Deeds in the county where your LLC’s Principal Office is located.

The recording fees are usually less than $20. (For example, here is the Register of Deeds Recording Services page for the Register of Deeds in Davidson County)

You’ll need to contact the appropriate Register of Deeds. You can do a Google search for the county name + “register of deeds”. Then call and ask to speak to the “recording department”. Ask about the recording fees, and get detailed instructions on how to send them your approved Articles of Organization.

Tennessee Secretary of State Contact Information

If you have questions about the LLC filing process, feel free to contact the Business Services Department of the Tennessee Secretary of State at 615-741-2286.

Their hours are Monday to Friday, 8:00am – 4:30pm Central Time.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Tennessee Articles of Organization FAQs

How much does it cost to register an LLC in Tennessee?

If your LLC has between 1 and 6 members, your LLC filing fee is $300.

If your LLC has more than 6 members, you will add an additional $50 per member (in addition to the $300) for each member over 6.

For example:

- If you have 7 members, your filing fee is $300 + $50 = $350.

- If you have 10 members, that’s 4 extra members at $50 each for a total filing fee of $300 + $200 = $500.

How much does an LLC cost per year in Tennessee?

Your Tennessee LLC must file an Annual Report and pay the fee every year.

This fee is paid to the Tennessee Secretary of State in order to keep your LLC in good standing.

How much you pay works the same as how much you paid for the Articles of Organization filing fee:

- If your LLC has between 1 and 6 members, your LLC Annual Report fee is $300.

- If your LLC has more than 6 members, you will add an additional $50 per member (in addition to the $300) for each member over 6.

What are the Articles of Organization for an LLC in Tennessee?

The Tennessee Articles of Organization is a form that tells the Secretary of State important information about your LLC. Once the Secretary of State approves your Articles of Organization, your LLC officially exists. The Articles of Organization are legal documents that create business entities.

The Articles of Organization form asks for your LLC name, business address, Registered Agent, and other information.

How do I get Articles of Organization in Tennessee?

You can get the Tennessee Articles of Organization from the state’s website.

The Secretary of State provides a template Tennessee Articles of Organization for you to use. You can download the PDF of Form SS-4270 for free. You can also complete this form online instead with the interactive online filing system.

Can I file the Tennessee Articles of Organization by mail?

Yes, if you prefer to file by mail (instead of online), there are two ways to do so:

1. You can go through the online filing system (follow the instructions above) and then print out your Articles of Organization form.

2. Instead of using the online system, you can simply download the Articles of Organization PDF form and complete it by hand or on your computer.

Once your Articles of Organization are completed, prepare a check or money order for $300 and make it payable to the “Tennessee Secretary of State”.

Mail your payment and completed, signed Articles of Organization to:

Secretary of State

Attn: Corporate Filing

6th Floor – Snodgrass Tower

312 Rosa L. Parks Avenue

Nashville, TN 37243

Approval: When submitting your Articles of Organization through the mail, your LLC will be approved in 3-5 business days (plus mail time).

Once your LLC is approved, you’ll receive a stamped and approved copy of your Articles of Organization along with an Acknowledgement Letter in the mail.

Don’t forget: Once you receive your approved Articles of Organization back in the mail, you should record them with the Register of Deeds in your county.

How do I get a copy of my Tennessee Articles of Organization?

If you’re looking for a copy of an Articles of Organization that you already filed for your LLC, you can get one for $20. The request for copies must be sent via mail to the Secretary of State.

- Download the Request for Copy of Documents Form (Form SS-4461) from the Tennessee Secretary of State.

- Complete the required information, and check the box for “Charter/Articles of Organization/Certificate and amendments”.

- Prepare a $20 check or money order payable to “Tennessee Secretary of State”.

- Mail your Form SS-461 and payment to:

State of Tennessee

ATTN: Certifications

312 Rosa L. Parks AVE, 6th FL

Nashville, TN 37243-1102

Note: If you just need a Certificate of Existence for your LLC, you can request it online. But this is not the same as your approved Articles of Organization.

Do you have to put LLC in your business name in Tennessee?

Yes, you have to put “LLC” (or another allowable ending) in your business name if you are forming an LLC. Tennessee allows the following endings:

- LLC

- L.L.C.

- Limited Liability Company

Tip: Most people choose “LLC”.

Your complete LLC name gets listed in your Tennessee Articles of Organization.

How long does it take to get an LLC approved in Tennessee?

If you form a Tennessee LLC online, it will be approved immediately.

If you form a Tennessee LLC by mail, it’ll take 3-5 business days (plus mail time) for the state to process your Articles of Organization filing.

Does my LLC need a Tennessee business license?

Whether you must obtain business licenses depends on what your business does.

Tennessee doesn’t have a state-wide general business license requirement.

However, the Tennessee Department of Revenue requires certain types of businesses to have a license. You should also check with your city or county about any local Tennessee business license requirements for your LLC.

And you may need to register with the Tennessee Department of Revenue in order to collect sales tax or register for other taxes.

Can I use the instructions above for filing a Foreign LLC?

No, the instructions on this page are specifically for filing a Domestic LLC in Tennessee.

If you want to register a Foreign LLC, you can find the forms and fees in Foreign LLC Fees by State.

How do I start an LLC in Tennessee?

Here are the steps to forming an LLC in Tennessee:

- Select a business name for your Tennessee LLC

- Choose your LLC’s Registered Agent

- File the LLC Articles of Organization with the state

- Complete and sign an LLC Operating Agreement

- Get an Employer Identification Number (EIN) from the Internal Revenue Service (IRS)

- Open a business bank account to protect your personal assets (how to get an LLC bank account)

- Check whether you need a business or sales tax license in Tennessee

References

Tennessee Secretary of State: Business Filings Online

Tennessee Secretary of State: Business Forms and Fees

Tennessee Secretary of State: Order Copies & Certificates

Tennessee Secretary of State: Next Steps for a New Business

Tennessee Secretary of State: Articles of Organization Form and Instructions (PDF)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Tennessee LLC Guide

Looking for an overview? See Tennessee LLC

Principal Office Address

“Enter your LLC’s Principal Office Address. This address can be any state, or in any country.”

Hello, I thought if you conduct business in TN then the principal office address will be inside TN. if the principal address is in another state for example in FL, you should register your business in FL? Thanks.

Hi Lee, it’s more so correct the other way around. Meaning, if an out-of-state LLC is registering as a Foreign LLC in Tennessee, they’d likely list an out-of-state Principle Office Address. However, just listing an out of state Principle Office Address isn’t a “declaration” of being a non-registered Foreign LLC. Hope that makes sense ;)

Hello Matt, I thinking of making an trucking transport LLC but I can’t think of a name. Can you help me out?

Hey Sean, we have some tips here: how to come up with a business name. Hope that helps.

Hi Matt, the Registered Agent information section is confusing me. Can you explain the difference between choosing, “the business entity will represent itself” and “Individual”? I’m the only member in my LLC and have the same address as my new business. I’m not sure which one to choose.

Thanks,

Molly

Hey Molly, your LLC can be its own Registered Agent or you can be your LLC’s Registered Agent. There is minor difference between the two, but you could also say that there is slightly more privacy when the LLC acts as it’s own Registered Agent. Does that help?